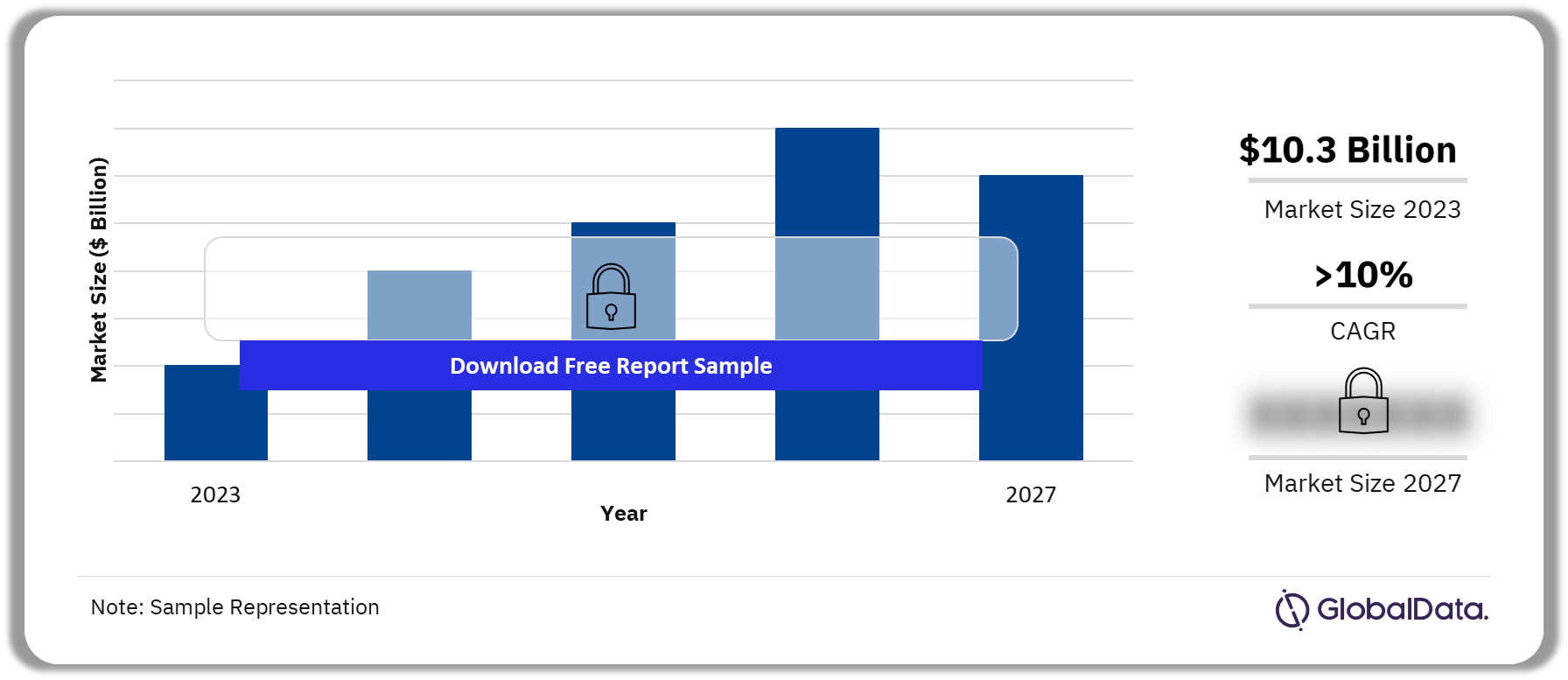

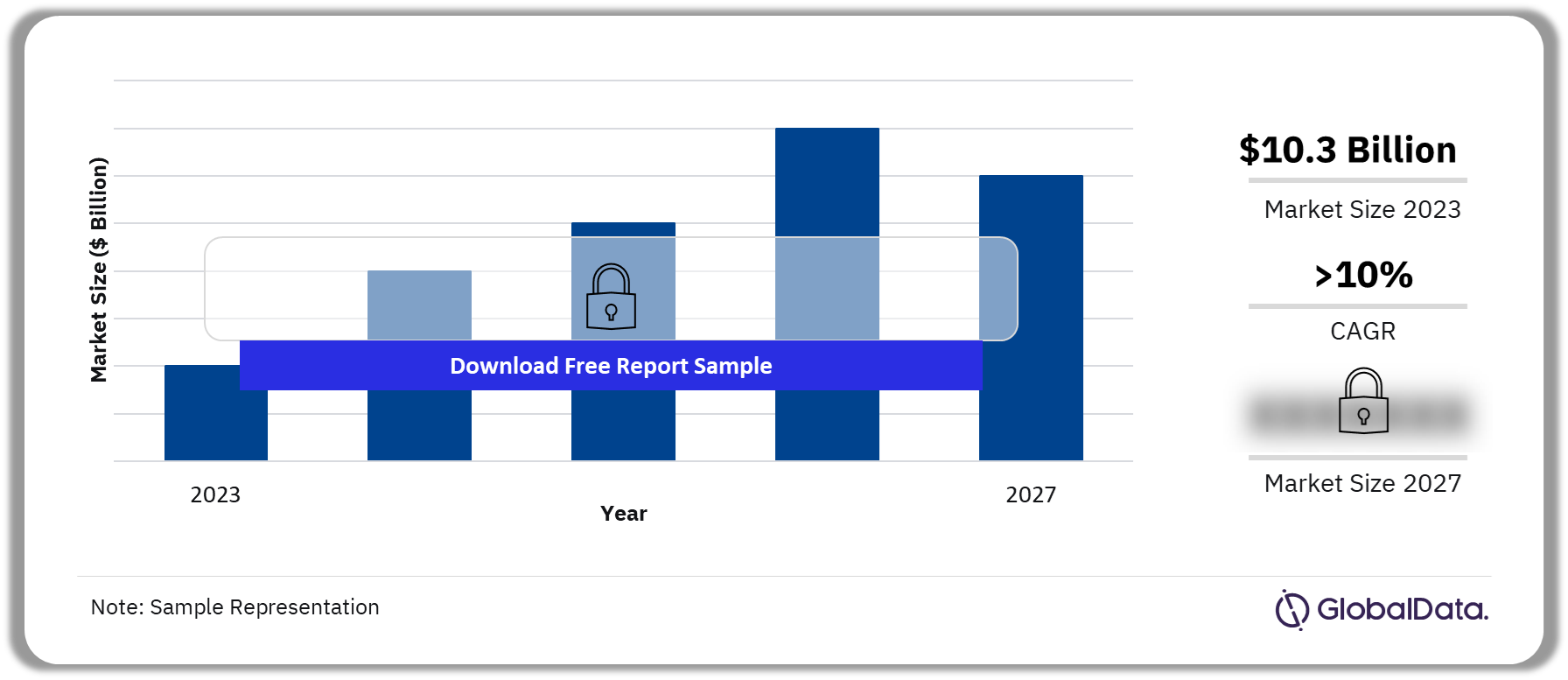

Overview of the Egypt Cards and Payments Market

The cards and payments market in Egypt is undergoing significant transformation, driven by a combination of economic growth, technological advancements, and changing consumer behaviors.

Buy the Full Report for More Information on the Egypt Cards and Payments Market Forecast Download a Free Sample Report

Here's a comprehensive overview of key aspects shaping the cards and payments landscape in Egypt:

1. Card Penetration:

- Egypt has witnessed a notable increase in card penetration, with debit and credit cards becoming more prevalent. Major international card networks such as Visa, Mastercard, and local card schemes are widely accepted, providing consumers with a variety of payment options.

2. Digital Payment Adoption:

- The adoption of digital payment methods is on the rise in Egypt. Mobile wallets, digital payment apps, and other electronic payment solutions are gaining popularity, especially among the tech-savvy younger population. This trend is contributing to the country's transition towards a more cashless society.

3. Government Initiatives:

- The Egyptian government has implemented initiatives to promote digital financial services and financial inclusion. Efforts include the digitization of government payments, the establishment of electronic payment infrastructure, and campaigns to raise awareness about the benefits of electronic transactions.

4. Financial Inclusion:

- Financial inclusion is a key focus in Egypt, with initiatives aimed at providing banking services to a broader segment of the population. The expansion of banking services, including the issuance of debit cards, contributes to increased financial participation among previously unbanked or underbanked individuals.

5. E-commerce Growth:

- The growth of e-commerce in Egypt has spurred the use of electronic payments. Consumers commonly use cards and digital wallets for online purchases, and the e-commerce sector continues to expand, creating a significant demand for secure and convenient payment methods.

6. Mobile Banking Services:

- Mobile banking services are gaining traction, allowing users to conduct various financial transactions through their mobile devices. Mobile banking apps offer functionalities such as fund transfers, bill payments, and account management, providing users with greater financial control.

7. Government Subsidy Programs:

- The government utilizes cards and digital payment methods in subsidy programs, including cash transfer initiatives. This contributes to financial inclusion while streamlining the distribution of subsidies to eligible beneficiaries through electronic means.

8. Technological Advancements:

- Technological advancements play a crucial role in shaping the cards and payments market. Contactless payments, biometric authentication, and advancements in payment processing systems contribute to a more efficient and secure payment ecosystem.

9. Regulatory Environment:

- The Central Bank of Egypt (CBE) plays a central role in regulating the cards and payments market. Regulatory measures ensure the stability of the financial sector, consumer protection, and adherence to international standards in financial transactions.

In summary, Egypt's cards and payments market is characterized by a dynamic shift towards digital solutions, financial inclusion initiatives, and a growing preference for electronic transactions. The collaborative efforts of the government, financial institutions, and technology providers contribute to the ongoing evolution of the payment landscape in Egypt.

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- Ασφάλεια

- Economy/Economic

- Beasts of Nations

- Machine Tools-The “Mother Industry”

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture