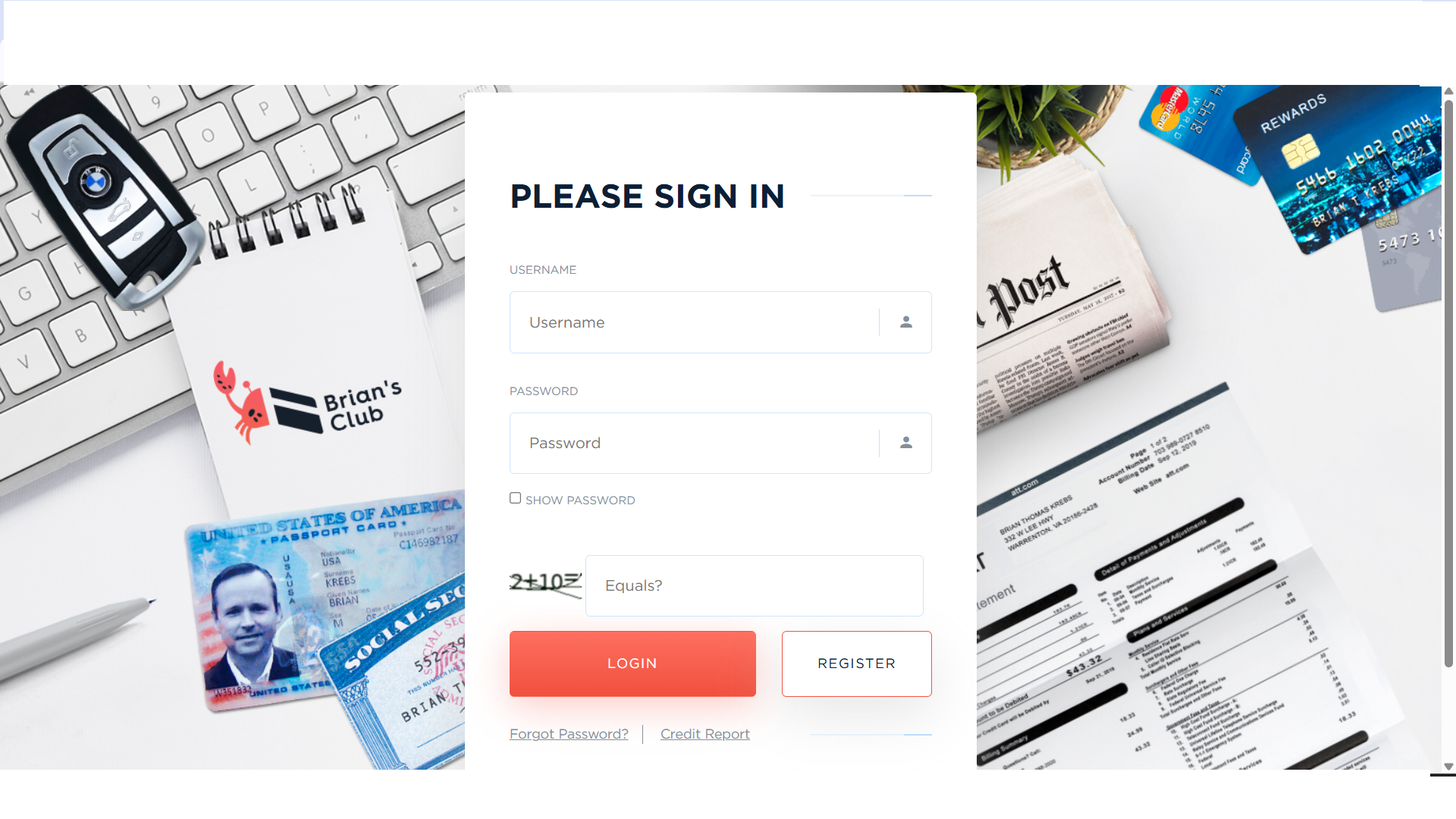

Why Is Bclub Frequently Discussed in These Contexts?

Bclub is a term that commonly pops up in conversations regarding credit card-related services. While many people wonder if it’s a reliable platform, others are skeptical about its legitimacy. In the world of cybercrime, such platforms often operate in secrecy, making it difficult to differentiate between genuine services and scams.

It’s important to note that engaging in the sale or purchase of stolen credit card information is illegal. Many governments and law enforcement agencies have implemented strict measures to crack down on such activities. Therefore, people who interact with unauthorized marketplaces are exposing themselves to severe legal risks.

The Risks of Dealing with Dumps and CVV2 Shops

Although the prospect of accessing credit card information might seem appealing to some, the reality is far from glamorous. There are numerous risks associated with participating in these illegal transactions.

-

Legal Consequences – Fraudulent activities are punishable by law. Individuals caught engaging in such acts may face imprisonment, hefty fines, and a permanent criminal record.

-

Financial Losses – Scammers often operate on these platforms, deceiving buyers with fake or invalid data. Many users end up losing their money without gaining any useful information.

-

Identity Theft – Sharing personal details on unreliable websites can lead to identity theft. Cybercriminals may misuse this information for further fraud or blackmail.

-

Lack of Recourse – Since these transactions are illegal, there is no legal support if a deal goes wrong. Victims have no way to report the scam without implicating themselves.

Why People Should Avoid Dumps and CVV2 Shops

Engaging in fraudulent activities not only has personal consequences but also causes significant harm to innocent individuals. Victims of credit card fraud often suffer from financial loss, stress, and damage to their credit scores. Many banks offer fraud protection, but the process of recovering lost funds can be lengthy and stressful.

Instead of seeking shortcuts, it’s always advisable to practice ethical financial habits. Legitimate financial institutions provide various services for secure online transactions. Tools like two-factor authentication, virtual cards, and fraud detection systems add extra layers of protection for users.

Staying Safe in the Digital World

Protecting your financial information is more critical than ever. Here are some practical steps to safeguard yourself against credit card fraud:

-

Monitor Transactions Regularly – Check your credit card statements frequently to spot any unauthorized transactions. Most banks offer mobile alerts for real-time updates.

-

Use Strong Passwords – Ensure that your online accounts have strong, unique passwords. Consider using a password manager for added security.

-

Enable Multi-Factor Authentication (MFA) – MFA provides an additional layer of protection, making it harder for unauthorized users to access your accounts.

-

Avoid Untrusted Websites – Be cautious when making online purchases. Ensure the website is legitimate and uses secure payment gateways.

-

Stay Informed – Learn about the latest phishing scams and fraud tactics to recognize and avoid them.

Can Financial Institutions Prevent Credit Card Fraud?

Financial institutions constantly upgrade their security measures to combat fraudulent activities. Advanced technologies like artificial intelligence and machine learning are used to detect suspicious behavior. These systems analyze patterns, flagging transactions that deviate from normal spending habits.

Additionally, most banks provide zero-liability protection for their customers. This means that cardholders are not held responsible for unauthorized transactions if they report them promptly. Such measures make it increasingly difficult for fraudsters to profit from stolen data.

Is Bclub a Safe Option?

Whether Bclub offers legitimate services or not remains a subject of debate. Given the risks associated with dealing in credit card data, it’s always best to avoid platforms that operate in the shadows. Trustworthy financial services provide secure and reliable solutions for all your credit card needs.

For those who value their financial security, there are numerous legal ways to manage and monitor your funds. From digital wallets to virtual cards, modern financial tools ensure safe transactions and protect you from fraud.

Final Thoughts

The temptation to explore dumps and CVV2 shops might arise from a desire for easy money, but the consequences far outweigh any short-term gains. Engaging in illegal financial activities can lead to severe penalties, financial loss, and reputational damage.

Instead, focus on building your financial knowledge and using secure, ethical platforms. By making informed decisions and practicing safe financial habits, you can protect yourself and others from the dangers of credit card fraud.

When it comes to financial matters, integrity and security should always be the priority. Stay informed, stay cautious, and make choices that safeguard your financial future.

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- الحماية

- Economy

- Beasts of Nations

- Machine Tools-The “Mother Industry”

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture