Effective Strategies to Increase Customer Share of Wallet in Banks

Effective Strategies to Increase Customer Share of Wallet in Banks

In an era where customer acquisition costs are rising and competition from digital-first banks is intensifying, maximizing value from existing customers has become a strategic imperative for financial institutions. While attracting new customers remains important, retaining and expanding relationships with current ones delivers faster, more sustainable growth. It’s also far more cost-effective, as the cost of acquiring a new customer is significantly higher than the cost of retaining one.

This is where focusing on the share of wallet from each customer becomes essential. It is a practical, measurable way to assess how much of a customer’s total financial relationship your institution holds. By focusing on enhancing customer marketing strategies, banks and credit unions can drive greater profitability without incurring the high costs associated with acquisition campaigns.

Understanding Share of Wallet and Its Impact

Share of Wallet refers to the percentage of a customer’s total financial activity, such as deposits, loans, credit cards, and investment products, that is held by your institution. For example, if a customer has $100,000 in total deposits across multiple banks and your institution holds $25,000 of that, your share of wallet is 25%.

Share of wallet is more than a metric; it’s a window into the depth of a relationship. Customers with higher wallet share are generally more loyal, more engaged, and less likely to churn. They are also more likely to respond to personalized offers and cross-sell opportunities, making them a valuable source of ongoing revenue.

Why Share of Wallet Matters for Growth

Ø Increase in Customer Loyalty and Retention

Customers who engage with more of your financial products are more likely to stay. Deeper relationships foster stronger emotional and functional bonds, making customers less likely to switch to a competitor. When a customer uses multiple services, such as checking, savings, credit, and loans, it signals trust and satisfaction. This multi-product engagement creates friction for switching, which supports increased customer retention.

Ø Increase Revenue Without Higher Acquisition Costs

Focusing on increasing the share of wallet allows banks to grow revenue more efficiently. Instead of spending heavily acquiring new customers, institutions can generate more value from the ones they already serve. Cross-selling and upselling tailored offerings to existing clients often results in quicker conversions and higher profitability, since those customers already have a relationship with the brand.

Ø Highlights Competitive Gaps

SoW analysis reveals the extent to which a customer’s financial activity is being directed elsewhere. Identifying these gaps helps banks understand unmet needs, assess market positioning, and take targeted actions to win back business from competitors.

Strategies to Increase Customer Share of Wallet

Ø Use Cross-Selling and Up-Selling Thoughtfully

Successful cross-selling and up-selling depend on timing and relevance. Rather than pushing products broadly, banks should use behavioral and transaction data to identify logical next steps in the customer's journey. For example, a customer with a savings account and consistent direct deposits may be ready for a credit card, mortgage, or investment product. Tailored recommendations demonstrate attentiveness and increase the likelihood of engagement.

Ø Deliver More Personal and Timely Experiences

Personalization is essential for today’s financial consumers; it can be considered one of the best customer loyalty strategies. Customers expect institutions to understand their needs and preferences. Personalized messages, pre-approved offers, and product suggestions tailored to spending behavior can significantly increase response rates. Timely outreach, such as offering home equity options when property values rise, enhances perceived relevance and drives higher adoption.

Ø Strengthen Relationships Through Trust and Consistency

Trust plays a critical role in financial decision-making. Consistent service quality, transparent communication, and responsive support build long-term loyalty. Loyalty programs that reward multi-product engagement or milestones, such as anniversaries or balance thresholds, can also strengthen the relationship and encourage customers to consolidate more of their financial activities with a single institution ultimately increasing their share of wallet.

Ø Offer Bundled Solutions That Add Value

Bundling services, such as combining checking, savings, overdraft protection, and personal loans into a single package, can simplify the customer experience and increase convenience. When customers see clear value in using multiple products together, they are more likely to keep a larger portion of their financial life with your institution. Bundling also supports pricing advantages and strengthens retention.

The Technology Gap: Why Traditional Systems Fall Short

Many banks still rely on fragmented data systems and manual processes, making it difficult to see the full picture of each customer’s financial relationship. Without integrated data, opportunities to grow the share of wallet often go unnoticed. Static reports and siloed tools hinder real-time analysis, slowing down decision-making and weakening cross-sell efforts. To effectively act on wallet, share strategies, institutions need a smarter approach, one that consolidates data, surfaces insights instantly, and recommends timely actions. Intelligent, real-time analytics are essential for transitioning from strategy to execution and ensuring that no opportunity is missed in a competitive market.

How Lumify360 Solution Helps Banks Grow Customer Share of Wallet

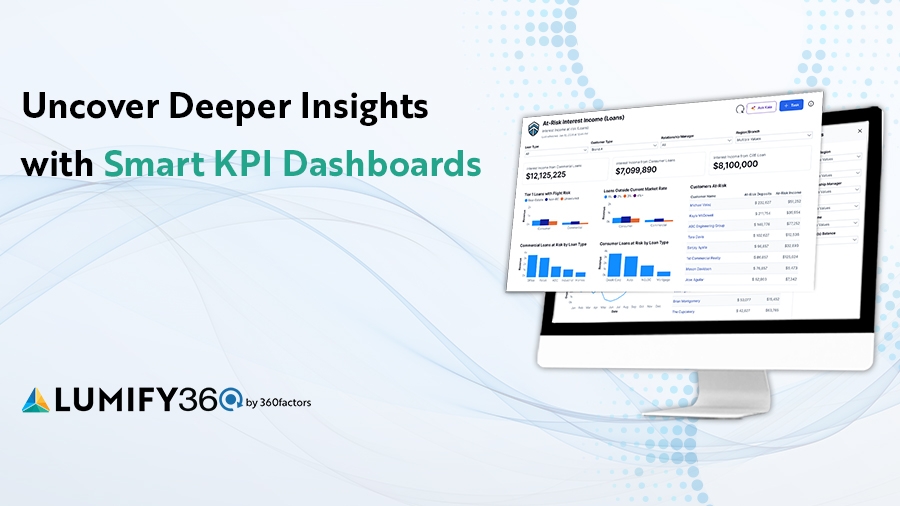

Implementing customer loyalty strategies to improve share of wallet is only as effective as the tools behind them. That’s where Lumify360 makes a measurable difference. This AI-powered platform is built to help banks and credit unions turn customer data into actionable insights that drive engagement and revenue. With 200+ data integrations offered, it connects siloed systems to create a unified view of each customer’s financial activity.

Built-in Power BI dashboards enable teams to track share-of-wallet trends and spot cross-sell and upsell opportunities with ease. Its predictive analytics engine goes further, suggesting the best actions based on behavioral patterns and transaction history.

Through Kaia, Lumify360's secure AI assistant, users can explore data using simple questions, generate charts, and uncover hidden opportunities without requiring additional technical teams.

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- الحماية

- Economy/Economic

- Beasts of Nations

- Machine Tools-The “Mother Industry”

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture