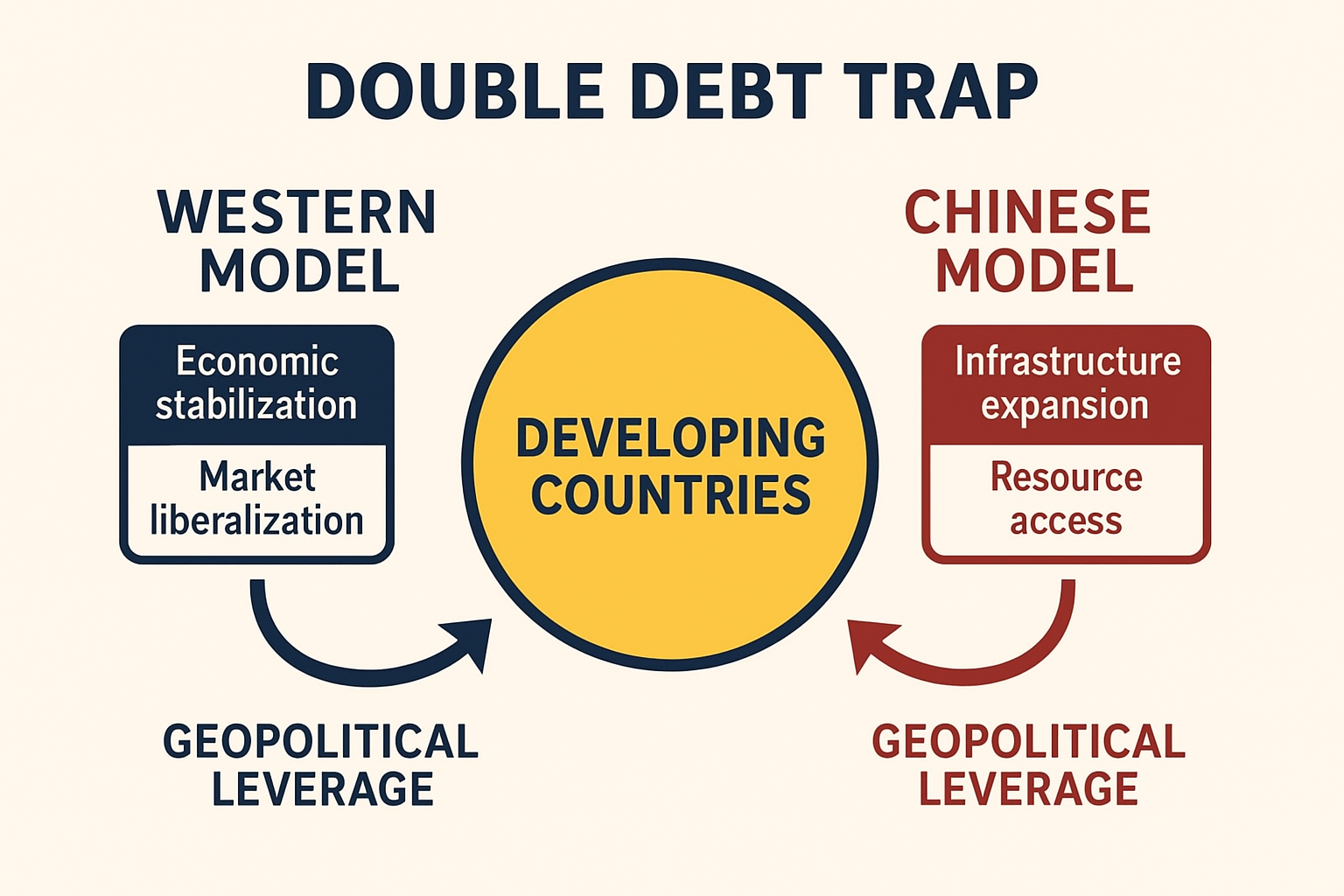

Evils of Double Debt Trap- Double standards of the IMF, World Bank, and Western banks

The double standards of the IMF, World Bank, and Western banks created both a vacuum and resentment in the Global South. China has stepped into that space, but instead of offering a purely “fairer” alternative, it often replaces one form of leverage with another.

1. Why China found an opening

-

Frustration with IMF/World Bank austerity: Many African, Asian, and Latin American governments were tired of structural adjustment, slow disbursements, and policy interference from Western-led lenders.

-

Need for fast, visible infrastructure: China offers quick financing and turnkey projects — roads, railways, ports, power plants — without lengthy governance lectures.

-

Political alignment: China frames itself as a partner from the Global South that also overcame poverty, making the offer sound less colonial.

2. The Chinese approach (Belt & Road model)

-

Loans for infrastructure — often at commercial or semi-concessional rates, but with faster approval and fewer social-policy strings.

-

Tied contracts: Chinese firms, labor, and materials are used, keeping much of the loan money circulating back to China.

-

Collateral clauses: Some deals are backed by natural resource exports or strategic assets (ports, mines, oil fields).

3. The coercive element

-

Debt leverage: If a country struggles to repay, China can renegotiate on terms that increase its strategic or economic control — e.g., 99-year leases, management rights over ports, exclusive mining rights.

-

Resource-backed loans: Payments in oil, minerals, or agricultural products can tie up national resources for decades.

-

Political influence: Debt dependence can sway foreign policy positions in the UN or regional blocs.

4. Examples

-

Sri Lanka (Hambantota Port) — Unable to service debt, government handed over a 99-year lease to a Chinese company.

-

Zambia — Heavy Chinese lending for infrastructure plus mining investments; restructuring talks raised fears of asset seizures.

-

Ecuador — Oil-backed loans to Chinese banks gave Beijing significant influence over crude exports.

-

Kenya — Concerns over Mombasa Port if Standard Gauge Railway debt turned sour (though officially denied).

5. How it links back to Western double standards

-

The West’s lending restricted development autonomy but didn’t build enough visible infrastructure — leaving many countries both indebted and underdeveloped.

-

China’s lending offers tangible assets quickly, but in exchange for long-term strategic influence and economic dependency.

-

Both systems prioritize lender security over borrower sovereignty, just with different rhetoric — the West uses “good governance” language, China uses “mutual development” language.

++++++++++++++++++++++++++++++++++++++++++++++++++++

Here’s the three-column comparison showing how the Western lending model and the Chinese lending model differ in style, but often lead to similar forms of leverage over developing nations.

Western Model vs Chinese Model vs Impact on Developing Countries

| Aspect | Western Model (IMF / World Bank / Western Banks) | Chinese Model (Belt & Road, State Banks) | Impact on Developing Countries |

|---|---|---|---|

| Primary Goal | Economic stabilization, debt repayment discipline, market liberalization. | Rapid infrastructure development, trade corridor expansion, resource access. | Countries choose between austerity with minimal new assets, or fast infrastructure with hidden costs. |

| Loan Terms | Often concessional but with heavy policy conditions (austerity, privatization, liberalization). | Mix of concessional and commercial loans; fewer governance/political conditions. | Western loans can choke growth via budget cuts; Chinese loans can create hidden high-interest or collateral risks. |

| Approval Speed | Slow — requires lengthy project evaluation, governance checks, IMF program alignment. | Fast — political agreement leads to rapid loan signing and construction start. | Chinese speed is attractive, but limits due diligence; Western slowness causes project delays. |

| Strings Attached | Macroeconomic reforms, subsidy cuts, tariff reductions, privatization of state assets. | Use of Chinese contractors, equipment, and labor; often resource-backed repayment. | Western conditions reshape domestic policy; Chinese conditions capture market share and resources. |

| Execution Model | Local contractors sometimes used, but major technical assistance from international consultants. | Turnkey projects run by Chinese firms with imported labor and materials. | Western model can build some local skills; Chinese model often sidelines local labor and firms. |

| Debt Risk Management | Debt sustainability analysis done upfront; restructuring tied to more austerity. | Debt risk sometimes underestimated; restructuring tied to asset or resource concessions. | Either way, debt traps are possible — just enforced differently. |

| Enforcement if Debt Fails | Restructuring with strict reforms; pressure to keep repaying through austerity. | Asset seizure/lease, resource export control, or strategic concessions. | Western approach hits social budgets; Chinese approach risks losing control over strategic assets. |

| Public Narrative | “Good governance” and “economic reform” for long-term stability. | “Win-win cooperation” and “development without interference.” | Both narratives downplay lender’s strategic and economic self-interest. |

| Geopolitical Leverage | Maintains influence through Bretton Woods institutions, trade access, sanctions power. | Expands influence through infrastructure corridors, debt dependence, and UN voting alignment. | Countries can become pawns in global power competition. |

| Example Countries | Ghana (austerity for IMF program), Argentina (structural reform), Mozambique (privatization). | Sri Lanka (Hambantota Port lease), Zambia (mining & infrastructure debt), Ecuador (oil-backed loans). | Mixed outcomes — short-term relief or infrastructure gains can lead to long-term dependence. |

Big Picture

-

Western model: Slower money, heavier reforms, less visible physical development — but deep policy control.

-

Chinese model: Fast money, big infrastructure, but heavy economic and resource strings — plus strategic asset risk.

-

Result: Many developing countries are now juggling both debts, creating dual dependence — vulnerable to pressure from two different global powers.

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- Segurança

- Economy

- Beasts of Nations

- Machine Tools-The “Mother Industry”

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture