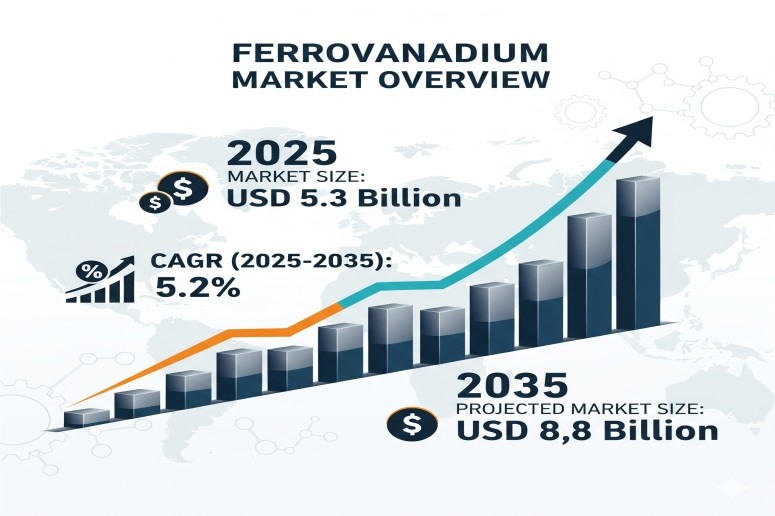

Ferro Vanadium Market 2025 Outlook, Current and Future Industry Landscape Analysis 2035

The global ferro vanadium market is entering an era of sustained expansion, fueled by growing industrialization, infrastructure development, and technological advancements in steel production and alloy applications. Valued at approximately USD 5.3 billion in 2025, the market is projected to register a steady compound annual growth rate (CAGR) of 5.2% over the next decade, reaching USD 8.8 billion by 2035.

Ferro vanadium, a key alloying component in high-strength, low-alloy (HSLA) steels, is critical to enhancing tensile strength, durability, and corrosion resistance. Its applications span construction, automotive, energy infrastructure, and emerging clean energy technologies. With the rise of smart cities and large-scale infrastructure projects in developing economies, reinforced steel incorporating ferro vanadium is increasingly indispensable for long-lasting bridges, pipelines, and earthquake-resistant structures.

Discover Market Opportunities – Get Your Sample of Our Industry Overview Today!

https://www.futuremarketinsights.com/reports/sample/rep-gb-1487

Driving Demand Across Industries

In the automotive sector, the trend toward vehicle light-weighting is accelerating, aligning with global carbon emission reduction targets. Ferro vanadium enables manufacturers to create thinner, yet stronger steel components, reducing overall vehicle weight without compromising safety. This trend is expected to gain further momentum as electric vehicle (EV) production scales up worldwide, generating fresh demand for advanced metal composites and lightweight structural alloys.

The oil and gas industry also relies heavily on ferro vanadium for high-performance drill pipes and equipment that must withstand extreme conditions. Increasing drilling depths and resource exploration make the toughness provided by ferro-vanadium-enriched steel increasingly valuable. Concurrently, global vanadium deposits are under strategic consideration, with resource nationalism and geopolitical tensions reshaping supply dynamics.

Shifting Supply Chains and Local Production Efforts

While China and Russia continue to dominate ferro vanadium supply, several nations are investing in local production and recycling initiatives to reduce import dependence. Governments are actively shaping market dynamics through regulations and strategic initiatives.

- In the United States, vanadium is classified as a critical mineral, with the government supporting domestic extraction and processing via funding programs such as the Defense Production Act. Fast-track permitting for mining projects aims to enhance industrial independence and national security.

- China maintains export quotas and environmental standards to balance domestic demand and control pollution.

- The European Union enforces stringent REACH regulations, mandating chemical safety evaluations for ferro vanadium imports. Anti-dumping duties have also been applied to counter low-priced imports from dominant exporters.

Global Trade Dynamics

The ferro vanadium market is shaped by a small number of production-heavy nations exporting to steel-intensive regions. China, Russia, South Korea, and Brazil lead global supply, while countries including the United States, Germany, Japan, and India remain import-dependent. China continues to supply Asia-Pacific and Europe, though export volumes fluctuate with domestic steel demand and policy. Russia’s exports, primarily targeting Europe and Asia, face constraints from sanctions and trade restrictions. South Korea, with a mature ferroalloy industry, exports across Southeast Asia, the USA, and Europe.

Trends Across End-Use Segments

The versatility of ferro vanadium extends beyond traditional steel applications. Consumer electronics, for instance, benefit from its strengthening properties in miniaturized devices, while industrial monitoring systems leverage the alloy for heat and stress resistance in extreme environments. Medical and sterilization applications rely on vanadium’s durability and biocompatibility, particularly in surgical instruments and diagnostic frames. Environmental monitoring equipment also increasingly incorporates ferro vanadium for corrosion-resistant performance.

Market Evolution and Future Outlook

Between 2020 and 2024, ferro vanadium’s primary role remained in steel reinforcement for construction, automotive, and heavy engineering. As infrastructure development accelerated globally, demand was sustained despite modest technological advancements.

From 2025 to 2035, the market is poised for transformation. Energy storage innovations, such as vanadium redox flow batteries, and aerospace and defense applications are driving investments in high-purity ferro vanadium. The sector is also shifting toward cleaner production technologies, including recycling and energy-efficient processing, in response to global sustainability mandates.

Production Process and Commercial Grade Insights

The market is dominated by two commercial grades: FeV 80 (46.5% market share) and FeV 60 (26% market share). FeV 80, with a higher vanadium content (78–82%), is preferred for HSLA steels used in automotive frames, pipelines, and industrial tools. Leading steel companies, including ArcelorMittal and POSCO, rely on FeV 80 to enhance performance while optimizing weight and cost. FeV 60, with lower vanadium content (58–62%), remains a cost-effective option for smaller steel mills and lower-end applications.

Production processes are primarily segmented into aluminothermic reduction and silicon reduction methods. The aluminothermic process dominates at 54% market share, favored for its energy efficiency and high-purity yield, producing FeV 80 for advanced applications. Silicon reduction, accounting for 38% share, is widely adopted in regions with lower electricity costs, producing FeV 60 and other price-sensitive grades.

Competitive Landscape

The ferro vanadium market is highly competitive, comprising global metallurgical corporations, specialty alloy manufacturers, and regional producers. Major players include:

- Atlantic Ltd. (20–24% market share): Specializes in high-purity ferro vanadium production and vanadium ore refining, emphasizing vertically integrated supply chains.

- AMG Advanced Metallurgical Group (16–20%): Develops high-performance alloys for steel, aerospace, and energy storage applications.

- Tremond Metals Corp. (12–16%): Focuses on customized ferro vanadium grades and efficient alloying technologies.

- Core Metals Group (10–14%): Supplies premium ferro vanadium for industrial and energy storage applications.

- Gulf Chemical and Metallurgical Corporation (8–12%): Pioneers vanadium recycling technologies to ensure sustainable alloy production.

Emerging players such as Pangang, HBIS Chengsteel, and other Asian producers are rapidly gaining market share by ramping up production, securing long-term vanadium ore supply, and integrating advanced extraction technologies. Mid-tier competitors like Bear Metallurgical Company, JFE Material, and Hickman, Williams & Companies focus on niche applications in aerospace alloys and specialty steels.

Regional Growth Highlights

- USA: CAGR 4.6%; demand driven by aerospace and high-strength steel industries. Key players: AMG Vanadium, Bear Metallurgical Company, TreibacherIndustrie AG.

- China: CAGR 5.4%; strong domestic steel and energy storage demand. Key players: Chengde Steel, Pangang Group Vanadium & Titanium.

- Germany: CAGR 4.1%; automotive and specialty alloy growth supported by Evonik Industries, TreibacherIndustrie AG.

- South Korea: CAGR 4.3%; focus on shipbuilding and electronics with POSCO, SeAH Besteel Corporation leading.

- UK, France, Italy, Japan, Australia, New Zealand: Moderate growth, supported by infrastructure, defense, and energy storage adoption.

Checkout Now to Access Industry Insights:

https://www.futuremarketinsights.com/checkout/1487

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- Security

- Economy

- Beasts of Nations

- Machine Tools-The “Mother Industry”

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture