Specialty Oilfield Chemicals — Strategic Outlook to 2034 & Beyond

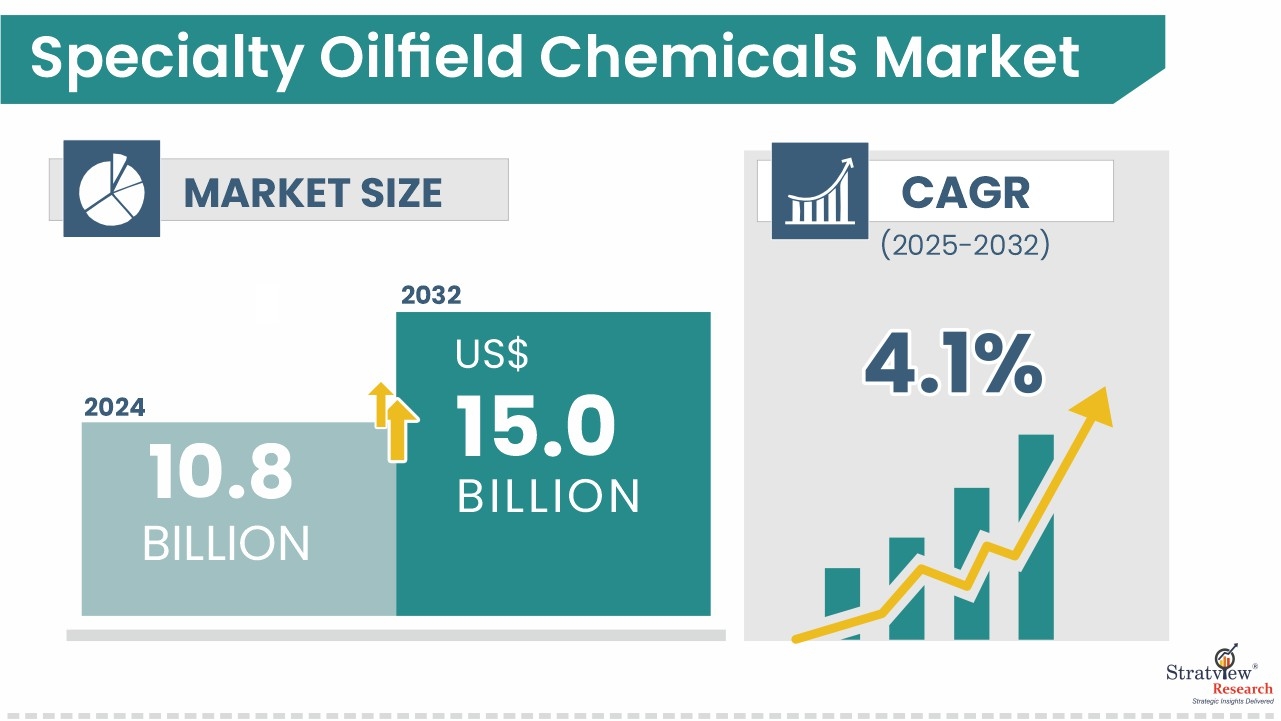

Looking further ahead, specialty oilfield chemicals are set to experience continued expansion. Other recent research suggests that by 2034, the specialty oilfield chemicals market could reach US$ 15.0 billion depending on product and regional segmentation. For example, forecasts show a CAGR of 4.1% over the 2025-2034 window.

Download the sample report here:

https://www.stratviewresearch.com/Request-Sample/1458/specialty-oilfield-chemicals-market.html#form

Drivers

- Enhanced oil recovery (EOR) & mature wells: As many oilfields age, recovery rates decline. Specialty chemicals are central to enhancing oil recovery in mature or challenging reservoirs (e.g., tight, deepwater, unconventional).

- Increased drilling activity & unconventional oil & gas production: Regions with shale gas, tight oil, or offshore drilling are increasing exploration & production efforts. This demands greater use of chemicals for drilling, stimulation, flow assurance, and well integrity.

- Cost optimization & operational efficiency: Operators aim to reduce downtime, improve lifetime of assets, reduce maintenance & failure risks. Specialty chemicals that mitigate corrosion, scale, and biological fouling help in cost reduction.

- Emergence of regulatory & environmental norms: As the world focuses more on environmental impact, the need for greener chemical solutions, reduced toxicity, better biodegradability, and lower environmental footprint becomes a competitive differentiator.

Trends

- Segment wise growth: Product types such as biocides, surfactants, inhibitors are likely to see above-average growth; demulsifiers, fluid loss additives etc. also maintain share.

- Application diversity: While production and drilling dominate, applications in well stimulation, enhanced oil recovery (EOR), and completion/workover are likely to grow faster.

- Regional expansion into emerging markets: Asia-Pacific, Latin America, Middle East will see increased demand, as investment in oil & gas infrastructure continues, and more stringent production optimization becomes necessary.

- Focus on green, sustainable and digital solutions: Development of environmentally friendly specialty reagents and chemicals, more precise chemical use via digital monitoring, IoT and AI, and newer formulations that reduce dosages and waste.

Conclusion

As the global energy landscape evolves, specialty oilfield chemicals remain vital. Forecasts suggest growth from around US$ 10.8 billion in the early 2020s (2023-2024) to US$ 15 billion by 2034 under ~4-1% CAGR. For companies in this space, the winning strategy will involve investing in high-value chemicals (biocides, inhibitors, EOR chemicals), moving toward sustainability and regulatory compliance, leveraging digital tools to optimize chemical usage, and focusing on fast-growing geographies. While risks like oil price volatility, environmental regulation, and raw material costs persist, the long-term opportunity is significant as oil & gas operations look to maximize recovery and efficiency in increasingly challenging reservoirs.

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- True & Inspiring Quotes

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- Security

- Economy/Economic

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture