What kind of government policies (tax incentives, subsidies, R&D funding, tariffs) are needed to build a sustainable machine tool sector?

What Kind of Government Policies Are Needed to Build a Sustainable Machine Tool Sector?

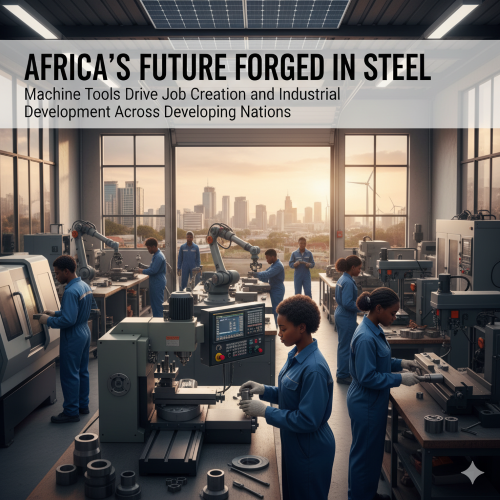

The machine tool industry—comprising lathes, milling machines, CNC systems, 3D printers, presses, and robotics—is often referred to as the “mother industry” because it enables the production of all other industrial goods.

Without it, no country can build cars, tractors, turbines, or even simple household appliances. For Africa and other developing economies, creating a sustainable machine tool sector is therefore critical for breaking free from raw material dependency and entering higher-value industrial production.

However, the machine tool sector requires long-term government support.

Left to market forces alone, it struggles in its early stages due to high capital costs, long payback periods, and competition from global giants in Germany, Japan, China, and South Korea.

This makes smart policies—tax incentives, subsidies, R&D support, tariffs, and human capital investments—indispensable.

1. Tax Incentives to Encourage Local Investment

Machine tool manufacturing is capital-intensive. Establishing plants requires advanced metallurgy, precision machining, and digital integration—all of which involve heavy upfront investment. To attract both local and foreign investors, governments can implement:

-

Tax holidays for new machine tool firms: Exemptions from corporate tax for the first 5–10 years of operation allow companies to reinvest profits into scaling up.

-

Accelerated depreciation allowances: Enabling firms to write off equipment and machinery investments more quickly reduces tax burdens and encourages reinvestment.

-

R&D tax credits: Companies investing in research, prototyping, and technology adaptation should be able to deduct a significant percentage of these expenses from taxable income.

-

Import duty exemptions for raw materials: While tariffs should protect finished machine tools, key inputs like steel alloys, precision bearings, and software should be exempted to lower costs for domestic manufacturers.

Impact: These policies reduce startup risks and help new machine tool firms reach competitiveness faster.

2. Subsidies and Financial Support

Given the strategic importance of machine tools, subsidies are essential to jumpstart production. Governments can provide:

-

Capital grants and soft loans: Direct support for purchasing precision equipment, especially CNC systems, robotics, and casting technologies.

-

Export subsidies: Encouraging firms to sell machine tools abroad creates scale, builds reputation, and strengthens foreign exchange earnings.

-

Cluster development subsidies: Concentrating machine tool firms in special industrial zones reduces costs through shared infrastructure, logistics, and research facilities.

-

Energy subsidies for heavy industries: Since metallurgy and machining are energy-intensive, preferential electricity tariffs or renewable energy integration can lower costs.

Example: South Korea’s government heavily subsidized its machine tool industry during the 1970s, enabling local firms to compete with Japanese and Western producers.

3. R&D Funding and Innovation Policies

A machine tool sector cannot survive on assembly and imitation alone—it must continuously innovate. Governments must therefore prioritize research and development (R&D) through:

-

National Machine Tool Research Institutes: Modeled on Germany’s Fraunhofer Institutes, such centers would focus on precision engineering, smart manufacturing, AI-driven production, and additive manufacturing.

-

University-Industry collaboration grants: Funding partnerships between engineering schools, polytechnics, and private firms ensures research outputs align with industry needs.

-

Open-source technology programs: Governments can sponsor platforms where machine tool designs, software codes, and technical manuals are shared across African firms to avoid duplication.

-

Innovation challenge funds: Competitions for startups and young engineers to design low-cost, Africa-adapted CNC machines or agricultural machinery tooling systems.

Impact: Sustained R&D reduces reliance on imported technologies, helps local firms develop unique solutions, and ensures competitiveness in global markets.

4. Tariffs and Trade Policy

No machine tool industry can survive without strategic protection, at least in its formative years. Without tariffs, African firms will be outcompeted by cheap imports from China or second-hand machinery from Europe.

-

Protective tariffs on imported finished machine tools: Tariffs of 10–20% can create breathing space for local firms while they build scale and expertise.

-

Anti-dumping laws: Prevent foreign companies from flooding African markets with cheap, subsidized machinery designed to wipe out emerging competitors.

-

Regional trade agreements under AfCFTA: Harmonizing tariffs across Africa ensures a large continental market for machine tools without intra-African competition.

-

Phased tariff reductions: Protection should not last forever; as firms become competitive, tariffs can be gradually lowered to encourage global integration.

Example: China’s meteoric rise in machine tool production was supported by protectionist policies for decades, allowing its companies to catch up before opening to global competition.

5. Skills Development Policies

Machine tools require highly skilled operators, designers, and engineers. Governments should align vocational training, polytechnics, and universities with the industry’s needs. Policies should include:

-

Curriculum reforms: Integrating CNC programming, robotics, and precision machining into technical education.

-

Apprenticeship programs: Incentivize firms to take on students for hands-on machine tool training.

-

Scholarships for engineering students: Focused on metallurgy, mechanical design, and AI-driven manufacturing.

-

Foreign training partnerships: Sending African engineers to Germany, Japan, or South Korea for specialized training, with a requirement to return and train others.

Impact: Skills development ensures Africa not only owns machine tool factories but also the human capital to sustain them.

6. Public Procurement and Local Content Policies

Governments are major buyers of industrial machinery—whether for construction, defense, energy, or agriculture. They can use procurement power to stimulate the sector:

-

“Buy African” procurement rules: Mandating that a percentage of government contracts for machinery go to domestic machine tool firms.

-

Local content requirements: Foreign companies operating in Africa must source part of their machinery or spare parts from local producers.

-

Infrastructure projects as demand drivers: Major projects (dams, railways, power plants) should create structured demand for locally made machine tools and spare parts.

Example: India used public procurement policies to nurture its machine tool industry, requiring domestic firms to supply equipment for state-run enterprises.

7. Financing Ecosystem and Industrial Policy Alignment

The machine tool industry requires long-term financing that traditional commercial banks may not provide. Governments should therefore:

-

Establish dedicated industrial banks: Offering low-interest loans specifically for manufacturing and machine tools.

-

Venture capital funds for industrial startups: Encouraging young African entrepreneurs to innovate in precision manufacturing.

-

Alignment with national industrialization plans: Machine tools must be integrated into broader strategies for automotive, agriculture, defense, and renewable energy sectors.

8. Environmental and Sustainability Policies

Machine tools consume significant energy and materials. To future-proof the sector, governments should encourage green manufacturing through:

-

Tax credits for energy-efficient machinery.

-

Incentives for recycling scrap metals into machine tool inputs.

-

Support for renewable energy integration into industrial zones.

This ensures Africa builds not just any machine tool industry, but a modern, sustainable one.

Building a sustainable machine tool sector requires deliberate, long-term policy interventions. Tax incentives can reduce startup risks; subsidies and financial support can lower costs; R&D funding drives innovation; tariffs protect young firms from global giants; and education policies develop the skilled workforce. Governments must also use public procurement to create guaranteed markets and align machine tool production with broader industrialization strategies.

The experience of countries like Germany, Japan, South Korea, and China shows that no machine tool sector succeeds without state intervention. For Africa, where industrial sovereignty and job creation are urgent priorities, governments must act decisively to nurture this sector. If the right mix of policies is put in place, Africa could move from being an importer of industrial machines to a producer—laying the foundation for self-reliant industrialization.

By Jo Ikeji-Uju

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- Security

- Economy

- Beasts of Nations

- Machine Tools-The “Mother Industry”

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture