Improving Bank Reconciliation Processes with Workday: A Comprehensive Training Manual

In today’s competitive business landscape, effective financial management is critical for success. One essential element of this is bank reconciliation, and Workday’s advanced financial management system makes this task significantly easier. This manual will cover the key aspects of Workday Bank Reconciliation Training, its benefits, and effective strategies for a smooth reconciliation process.

If you want to excel in this career path, then it is recommended that you upgrade your skills and knowledge regularly with the latest Workday Online Training.

What is Bank Reconciliation?

Bank reconciliation is the process of aligning a company’s internal financial records with its bank statements to ensure accuracy and consistency. This crucial task helps identify discrepancies, prevent fraud, and maintain a clear understanding of cash flow.

Why Utilize Workday for Bank Reconciliation?

Workday provides a cloud-based financial management solution that integrates seamlessly with various business functions. Here are some key advantages:

- Real-time Data Access: Workday offers current financial information, facilitating timely reconciliations.

- Automation: Automated processes minimize the risk of human error and save valuable time.

- In-depth Reporting: Workday’s comprehensive reporting tools enable thorough financial analysis.

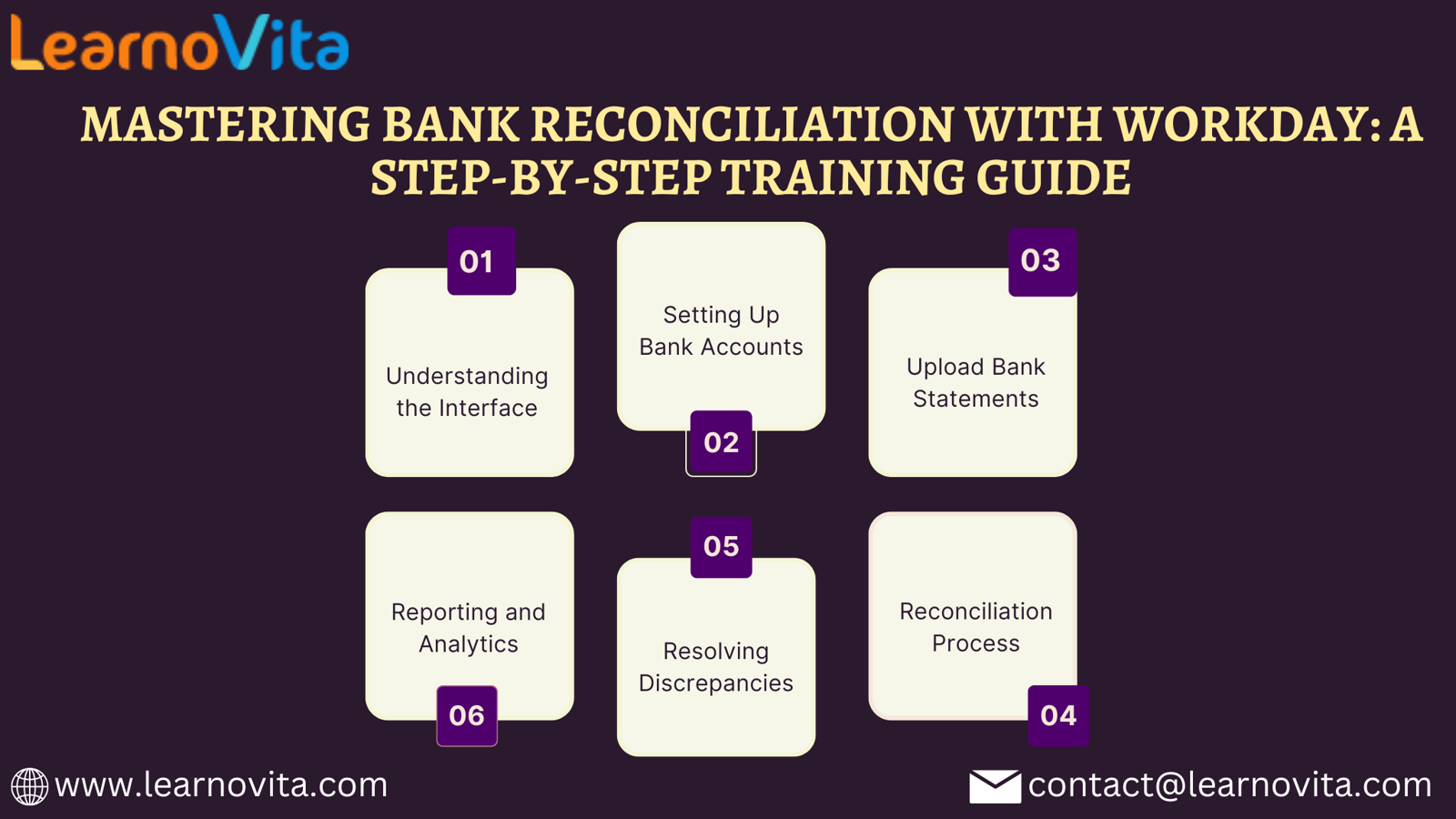

Core Components of Workday Bank Reconciliation Training

-

Navigating the Interface: Familiarize yourself with the Workday dashboard and its features related to bank reconciliation.

-

Setting Up Bank Accounts: Learn how to create and manage bank accounts in Workday and link them to your financial records.

-

Uploading Bank Statements: Understand the steps for uploading bank statements to compare with internal records.

-

Executing the Reconciliation Process: Gain practical experience in the reconciliation workflow, including transaction matching and resolving discrepancies.

-

Addressing Discrepancies: Training will cover common challenges in reconciliation and provide effective strategies for resolution.

-

Leveraging Reporting and Analytics: Discover how to utilize Workday’s reporting features to analyze reconciliation outcomes and monitor cash flow.

With the aid of Best Software Training Institute programs, which offer comprehensive training and job placement support to anyone looking to develop their talents, it’s easier to learn this tool and advance your career.

Best Practices for Effective Bank Reconciliation

- Conduct Regular Reconciliations: Perform reconciliations on a monthly or quarterly basis to identify issues early.

- Maintain Thorough Documentation: Keep clear records of reconciliations and any adjustments for future reference.

- Foster Team Collaboration: Work closely with your accounting team to ensure consistency in financial data.

- Commit to Continuous Learning: Stay informed about Workday updates and best practices in financial management.

Conclusion

Workday Bank Reconciliation Training equips finance professionals with the skills necessary for effective financial oversight. With its intuitive interface and powerful capabilities, Workday streamlines the reconciliation process, ensuring both efficiency and accuracy. By implementing best practices and utilizing the available tools, organizations can enhance their financial health and make informed decisions.

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- Security

- Economy

- Beasts of Nations

- Machine Tools-The “Mother Industry”

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture