How does climate change and competition for resources, like water and critical minerals, create new geopolitical tensions and conflicts?

Climate change and competition for resources intensify geopolitical tensions by acting as "threat multipliers" that exacerbate existing fragilities and create new vulnerabilities.

The scarcity of vital resources like water and critical minerals, driven by environmental shifts and technological demands, increases the likelihood of disputes, migration, and economic coercion between nations.

Climate Change and Resource Scarcity-

Climate change directly impacts resource availability, leading to geopolitical stress. As temperatures rise, sea levels change, and weather patterns become more extreme, the distribution of essential resources is fundamentally altered.

Water Scarcity: Climate change leads to more frequent and severe droughts, which puts pressure on transboundary rivers and aquifers.

For example, in regions like the Nile Basin or the Tigris-Euphrates river system, upstream nations constructing dams can severely restrict water flow to downstream countries.

This creates a zero-sum dynamic where one country's development (e.g., hydroelectric power) directly threatens another's food security and stability, escalating tensions and increasing the risk of conflict.

Food and Land Security: Climate-related events like floods, droughts, and desertification reduce arable land and crop yields. This can lead to food insecurity, driving up prices and triggering social unrest and political instability, particularly in developing nations. Mass displacement due to uninhabitable land further strains resources in host countries and can become a source of international tension.

Competition for Critical Minerals

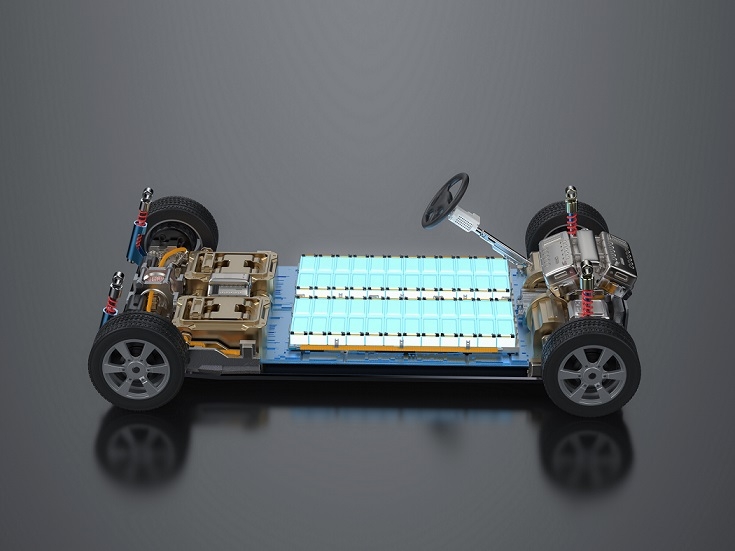

The global shift towards clean energy and advanced technologies has created a new arena for geopolitical competition centered on critical minerals. These minerals, such as lithium, cobalt, and rare earth elements, are essential for manufacturing electric vehicles, solar panels, and high-tech electronics.

Supply Chain Vulnerability: The production and processing of many critical minerals are highly concentrated in a small number of countries. This creates a choke point in the global supply chain, making nations dependent on these suppliers vulnerable to economic coercion or disruption. For instance, China's dominance in the refining of rare earth elements gives it significant leverage over countries that need them for their technological industries.

Resource Nationalism: Resource-rich nations are increasingly adopting "resource nationalism," where they assert greater control over their mineral deposits through nationalization or export restrictions. Their aim is to maximize economic benefits and develop their own processing industries. This trend can disrupt global markets and create friction with importing nations seeking to secure a stable supply.

Strategic Alliances and Rivalries: The quest for critical minerals is reshaping international alliances. The United States and its allies are working to create new supply chains and partnerships to reduce their reliance on rivals like China. This has led to strategic investment in new mining projects and the formation of new agreements, effectively carving the world into competing industrial blocs and further intensifying geopolitical rivalries.

How does climate change and competition for resources, like water and critical minerals, create new geopolitical tensions and conflicts?

Climate change and competition for resources intensify geopolitical tensions by acting as "threat multipliers" that exacerbate existing fragilities and create new vulnerabilities.

The scarcity of vital resources like water and critical minerals, driven by environmental shifts and technological demands, increases the likelihood of disputes, migration, and economic coercion between nations.

Climate Change and Resource Scarcity-

Climate change directly impacts resource availability, leading to geopolitical stress. As temperatures rise, sea levels change, and weather patterns become more extreme, the distribution of essential resources is fundamentally altered.

Water Scarcity: Climate change leads to more frequent and severe droughts, which puts pressure on transboundary rivers and aquifers.

For example, in regions like the Nile Basin or the Tigris-Euphrates river system, upstream nations constructing dams can severely restrict water flow to downstream countries.

This creates a zero-sum dynamic where one country's development (e.g., hydroelectric power) directly threatens another's food security and stability, escalating tensions and increasing the risk of conflict.

Food and Land Security: Climate-related events like floods, droughts, and desertification reduce arable land and crop yields. This can lead to food insecurity, driving up prices and triggering social unrest and political instability, particularly in developing nations. Mass displacement due to uninhabitable land further strains resources in host countries and can become a source of international tension.

Competition for Critical Minerals

The global shift towards clean energy and advanced technologies has created a new arena for geopolitical competition centered on critical minerals. These minerals, such as lithium, cobalt, and rare earth elements, are essential for manufacturing electric vehicles, solar panels, and high-tech electronics.

Supply Chain Vulnerability: The production and processing of many critical minerals are highly concentrated in a small number of countries. This creates a choke point in the global supply chain, making nations dependent on these suppliers vulnerable to economic coercion or disruption. For instance, China's dominance in the refining of rare earth elements gives it significant leverage over countries that need them for their technological industries.

Resource Nationalism: Resource-rich nations are increasingly adopting "resource nationalism," where they assert greater control over their mineral deposits through nationalization or export restrictions. Their aim is to maximize economic benefits and develop their own processing industries. This trend can disrupt global markets and create friction with importing nations seeking to secure a stable supply.

Strategic Alliances and Rivalries: The quest for critical minerals is reshaping international alliances. The United States and its allies are working to create new supply chains and partnerships to reduce their reliance on rivals like China. This has led to strategic investment in new mining projects and the formation of new agreements, effectively carving the world into competing industrial blocs and further intensifying geopolitical rivalries.