Fast-track MSME loan disbursement with an easy-to-deploy Loan origination system—CredAcc’s no-code platform keeps it quick and affordable.

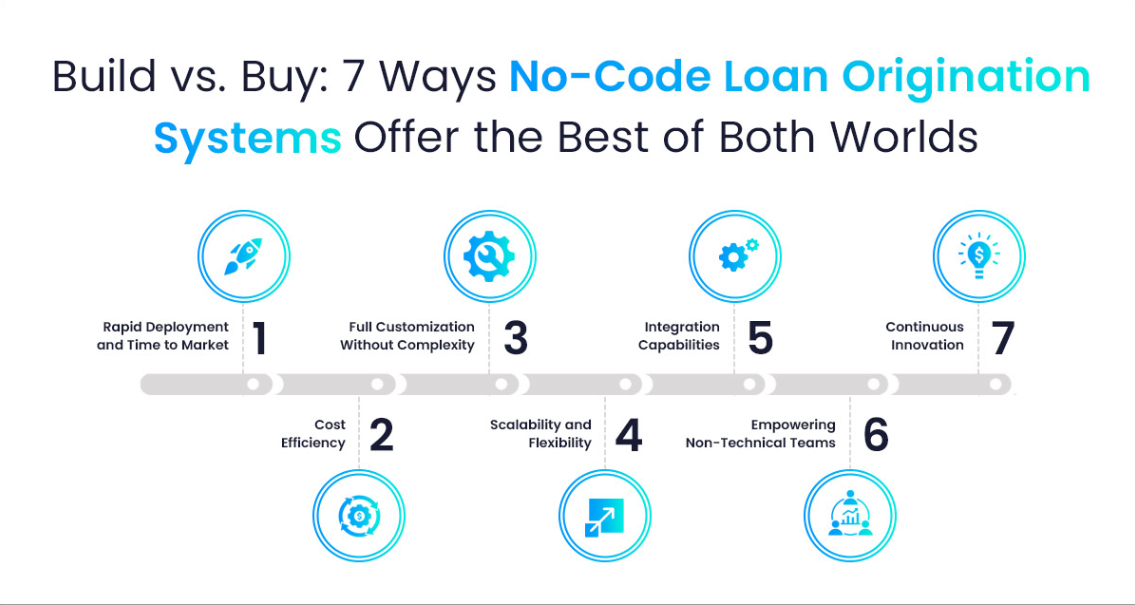

CredAcc’s no-code Loan origination system offers an innovative solution for MSME lending, simplifying the way banks and NBFCs process loans. By eliminating the need for complex coding, the platform empowers non-technical teams to design and manage loan workflows with ease. Financial institutions can quickly respond to market demands and regulatory changes without waiting for months of development. The Loan origination system is designed to be flexible, allowing for customization based on the institution’s specific needs. It reduces errors, speeds up processing, and ultimately enhances customer satisfaction. Whether you're a small NBFC or a large bank, CredAcc's system can scale with your business.

Visit for more info :- https://www.credacc.com/loan-origination-system

CredAcc’s no-code Loan origination system offers an innovative solution for MSME lending, simplifying the way banks and NBFCs process loans. By eliminating the need for complex coding, the platform empowers non-technical teams to design and manage loan workflows with ease. Financial institutions can quickly respond to market demands and regulatory changes without waiting for months of development. The Loan origination system is designed to be flexible, allowing for customization based on the institution’s specific needs. It reduces errors, speeds up processing, and ultimately enhances customer satisfaction. Whether you're a small NBFC or a large bank, CredAcc's system can scale with your business.

Visit for more info :- https://www.credacc.com/loan-origination-system

Fast-track MSME loan disbursement with an easy-to-deploy Loan origination system—CredAcc’s no-code platform keeps it quick and affordable.

CredAcc’s no-code Loan origination system offers an innovative solution for MSME lending, simplifying the way banks and NBFCs process loans. By eliminating the need for complex coding, the platform empowers non-technical teams to design and manage loan workflows with ease. Financial institutions can quickly respond to market demands and regulatory changes without waiting for months of development. The Loan origination system is designed to be flexible, allowing for customization based on the institution’s specific needs. It reduces errors, speeds up processing, and ultimately enhances customer satisfaction. Whether you're a small NBFC or a large bank, CredAcc's system can scale with your business.

Visit for more info :- https://www.credacc.com/loan-origination-system

0 Comments

0 Shares

907 Views

0 Reviews