Black & Scholes Option Calculator

The Black-Scholes model is a mathematical formula used to determine the theoretical price of European-style options. It was developed by Fischer Black and Myron Scholes in 1973 and later refined by Robert Merton. This model helps traders, investors, and analysts calculate the fair price of options based on various input parameters.

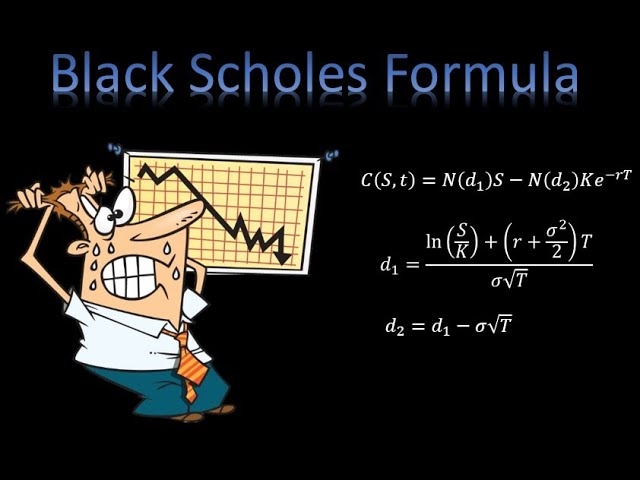

Black-Scholes Formula

The Black-Scholes equation for pricing a European call option is:

For a put option, the formula is:

Where:

-

C = Price of the call option

-

P = Price of the put option

-

S₀ = Current stock price

-

X = Strike price of the option

-

r = Risk-free interest rate (annualized)

-

t = Time to expiration (in years)

-

σ = Volatility of the underlying asset (annualized)

-

N(d) = Cumulative standard normal distribution function

-

d₁ and d₂ are calculated as:

How to Use a Black-Scholes Option Calculator

A Black-Scholes Option Calculator simplifies the complex calculations by allowing users to input the required parameters and obtain the option price instantly. Most online calculators require the following inputs:

-

Stock Price (S₀) – The current price of the underlying stock.

-

Strike Price (X) – The predetermined price at which the option can be exercised.

-

Time to Expiration (T) – The time left until the option expires (in years).

-

Risk-Free Interest Rate (r) – The return on a risk-free investment (e.g., government bonds).

-

Volatility (σ) – The standard deviation of the stock’s returns, representing market uncertainty.

-

Option Type – Choose between a Call or Put option.

Once the user inputs these values, the calculator computes the option price based on the Black-Scholes formula.

Assumptions of the Black-Scholes Model

The Black-Scholes model is widely used but relies on certain assumptions:

-

The option is European-style, meaning it can only be exercised at expiration.

-

The stock price follows a lognormal distribution and moves continuously.

-

There are no arbitrage opportunities in the market.

-

The risk-free rate and volatility remain constant over the option's life.

-

The market is frictionless, meaning no transaction costs or taxes.

-

No dividends are paid during the option's life (though modified versions account for dividends).

Limitations of the Black-Scholes Model

While the Black-Scholes model is useful, it has some limitations:

-

It does not work well for American options, which can be exercised anytime before expiration.

-

It assumes constant volatility, whereas real market conditions can be more dynamic.

-

It does not account for market frictions, such as transaction costs and liquidity constraints.

-

It does not handle extreme market conditions, such as high volatility or financial crises.

Conclusion

The black & scholes option calculator is a powerful tool for pricing options efficiently. By inputting key variables, traders and investors can estimate the fair value of an option and make informed trading decisions. However, it is essential to understand the model's assumptions and limitations before relying on its results. For real-world trading, combining the Black-Scholes model with other risk management techniques is recommended.

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- Seguridad

- Economy

- Beasts of Nations

- Machine Tools-The “Mother Industry”

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture