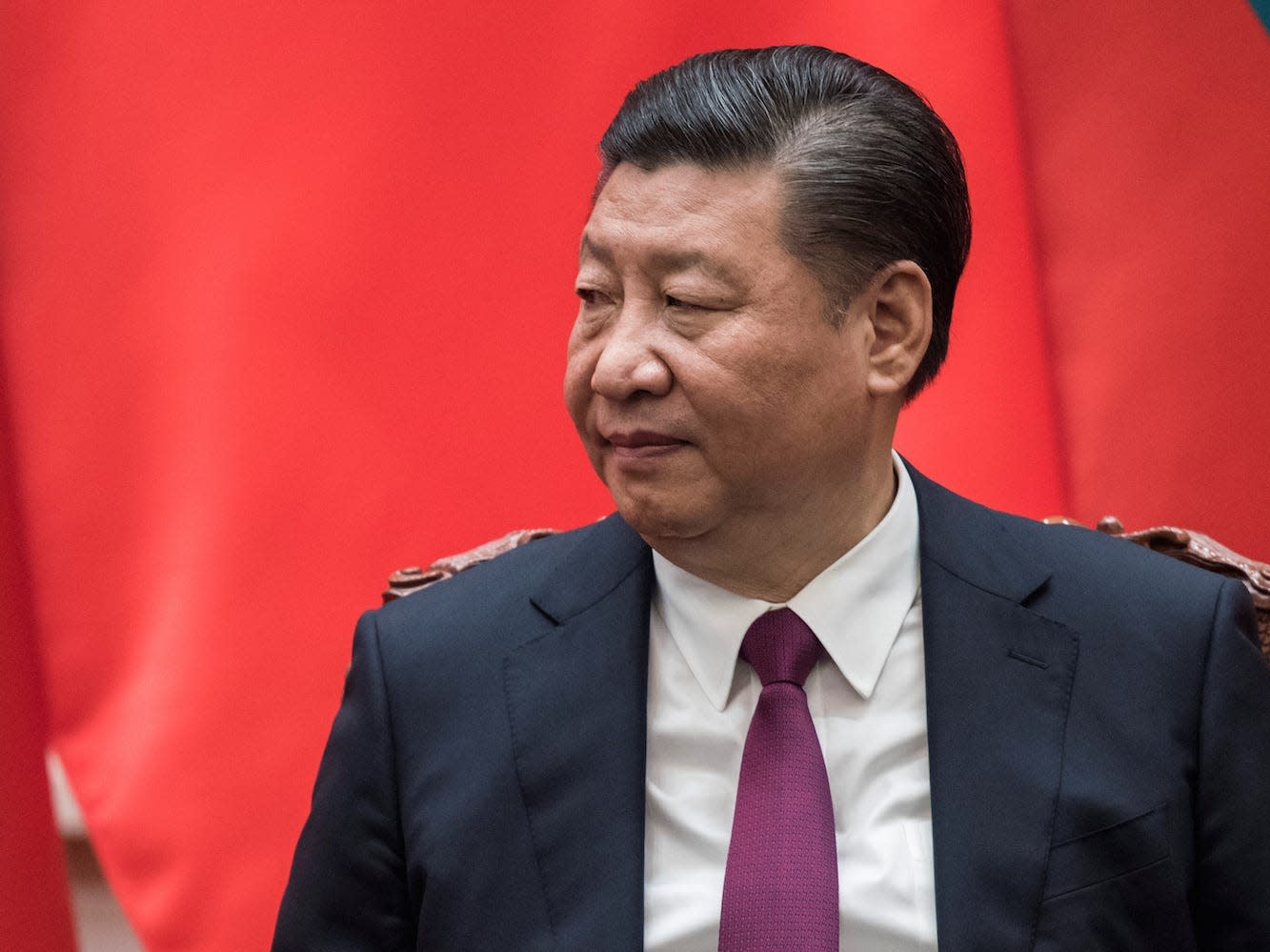

China is likely headed for a full-blown financial crisis as its economy is due for wilder swings, market expert says

-

China's economy is likely headed for a financial crash, market veteran Ruchir Sharma warned.

-

That's because of the property bubble that was fueled by soaring debts, he said in the Financial Times.

-

"In this scenario, the next big step for China is a full-blown financial crisis."

As outlooks on the long-term future of the Chinese economy turn increasingly dimmer, a closer look at its near-term prospects offer two potential paths, Ruchir Sharma wrote in the Financial Times.

In one scenario, the country may still undergo a few rebounds as its economic slowdown sets in, similar to the "false dawns" that Japan saw in the 1990s, according to the chair of Rockefeller International.

If temporary bouncebacks occur, they might come from China's tech sector, which continues to outperform those of other leading economies, Sharma wrote. Despite Beijing's heavy-handed regulation of its tech firms, these industries continue to grow; for instance, China has become the world's top exporter of electric vehicles this year.

But under another scenario, China's property market may end up mirroring US real estate in the summer 2008, when a downturn was underway but Wall Street didn't see a collapse.

"In this scenario, the next big step for China is a full-blown financial crisis," Sharma wrote.

Amid a growing list of headwinds sweeping through China's economy, its property market is a leading negative. The sector, which accounts for up to a third of the nation's GDP, has been drawn down by deep debt.

According to Sharma, land and home prices have annually fallen around 5%, while the funding vehicles used by local governments to purchase property now make up almost half of China's government debt. Defaults have been common in the sector, with even its most stable developers at risk.

And unlike Tokyo in the 1990s, Beijing has shown deep hesitancy in launching broad economic stimulus. Instead, it has introduced a number of smaller support measures that have had a limited impact so far.

"Since property bubbles fueled by surging debts tend to end in sharper economic downturns than what China has seen so far, the crisis scenario is a bit more probable than a big bounceback," Sharma said. "Whether China's next step takes it for the better or worse, it's likely to be a good deal more dramatic than the muddling scenario the consensus expects."

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- Segurança

- Economy

- Beasts of Nations

- Machine Tools-The “Mother Industry”

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture