Takaful Insurance Market Evolution 2024-2030: A Deep Dive into Key Developments

Introduction

Takaful insurance, a Shariah-compliant alternative to conventional insurance, has been gaining momentum across global markets. With ethical financial principles at its core, Takaful operates on mutual cooperation and shared responsibility, attracting both Muslim and non-Muslim investors. As financial inclusivity and Islamic finance continue to expand, the Takaful Insurance Market is witnessing remarkable growth. This blog delves into the latest trends, key players, and future outlook of the Takaful insurance industry.

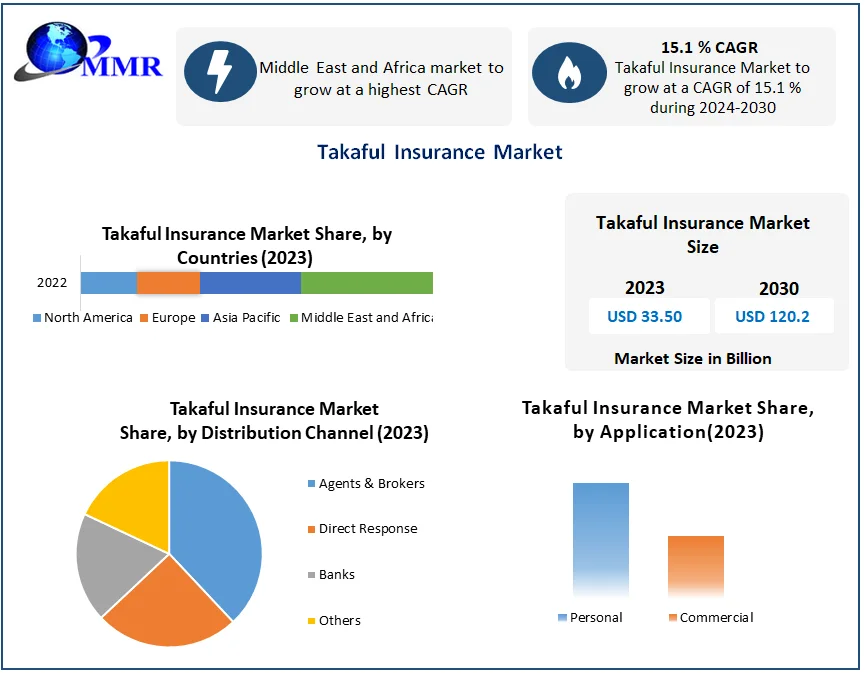

Market Overview & Growth Trends

The global Takaful insurance market has been experiencing steady growth, driven by increasing demand for ethical insurance, regulatory support in key markets, and a rise in disposable incomes among Muslim-majority populations. Key trends include:

-

Increasing Awareness and Acceptance: Governments and financial institutions are promoting Takaful as a viable alternative to conventional insurance, leading to wider adoption.

-

Technological Advancements: Digitalization and InsurTech are reshaping the market, enhancing accessibility, operational efficiency, and customer experience.

-

Expansion in Non-Muslim Markets: Many non-Muslim countries are exploring Takaful offerings, recognizing its ethical investment principles.

-

Regulatory Reforms and Standardization: Governments are implementing supportive regulations to ensure transparency and governance in the Takaful sector.

-

Rising Demand for Health and Family Takaful: As awareness of health insurance increases, family and medical Takaful products are gaining popularity.

Click Here For Free Sample Report Link:https://www.maximizemarketresearch.com/request-sample/213737/

Market Segmentation

The Takaful insurance market can be segmented based on type, distribution channels, and geography.

By Type:

-

General Takaful: Covers property, motor, marine, and liability insurance.

-

Family Takaful: Provides life, health, and education-related insurance plans.

By Distribution Channel:

-

Bancatakaful: Offered through banking institutions.

-

Direct Sales: Provided by Takaful companies directly.

-

Online Platforms: Digital expansion has led to online Takaful services.

-

Brokers & Agents: Traditional intermediaries continue to play a role in policy distribution.

By Geography:

-

Middle East & Africa (MEA): The largest market due to high Muslim population and supportive regulations.

-

Asia-Pacific: Malaysia and Indonesia are leading hubs for Takaful growth.

-

Europe: Countries such as the UK and Germany are witnessing increased demand for Shariah-compliant financial services.

-

North America: A growing segment as awareness spreads among financial institutions.

More Insights Of Full Report In Details:https://www.maximizemarketresearch.com/market-report/takaful-insurance-market/213737/

Key Players in the Takaful Insurance Market

Several key players dominate the global Takaful insurance market, offering innovative and diverse insurance solutions. Some of the prominent ones include:

-

Malaysian Takaful Association (Malaysia)

-

Dubai Islamic Insurance & Reinsurance Co. (AMAN) (UAE)

-

Abu Dhabi National Takaful Co. (UAE)

-

Saudi Reinsurance Company (Saudi Re) (Saudi Arabia)

-

Qatar Islamic Insurance Company (Qatar)

-

Islamic Insurance Company (Jordan)

-

Syarikat Takaful Malaysia Keluarga Berhad (Malaysia)

-

Zurich Takaful Malaysia Berhad (Malaysia)

These companies are continuously innovating to provide competitive and Shariah-compliant insurance solutions.

Future Outlook and Opportunities

The future of the Takaful insurance market looks promising, with several growth drivers set to shape the industry:

-

Government Initiatives & Regulatory Frameworks: Enhanced legal frameworks will facilitate market expansion.

-

Integration with Fintech: Blockchain and AI-driven insurance models will revolutionize the sector.

-

Expansion in Non-Muslim Markets: Ethical investments are attracting non-Muslim customers, expanding Takaful’s reach.

-

Growing Demand for Retirement & Health Takaful: As life expectancy rises, more consumers are looking for Shariah-compliant retirement and healthcare plans.

-

Sustainability & ESG Investments: Takaful aligns well with ESG (Environmental, Social, and Governance) principles, attracting ethical investors.

Conclusion

The Takaful insurance market is set for significant expansion, driven by rising awareness, digital transformation, and regulatory support. With key players investing in innovative financial products, the market is poised to become a major force in global insurance. Businesses and consumers looking for ethical, Shariah-compliant insurance options should keep an eye on this evolving sector.

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- Securitate

- Economy

- Beasts of Nations

- Machine Tools-The “Mother Industry”

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture