Trade Finance Market Size, Share, And Trends Report

IMARC Group, a leading market research company, has recently released a report titled “Trade Finance Market Report by Finance Type (Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance), Offering (Letters of Credit, Bill of Lading, Export Factoring, Insurance, and Others), Service Provider (Banks, Trade Finance Houses), End-User (Small and Medium Sized Enterprises (SMEs), Large Enterprises), and Region 2025-2033”. The study provides a detailed analysis of the industry, including the global trade finance market trends, share, size, and industry trends forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

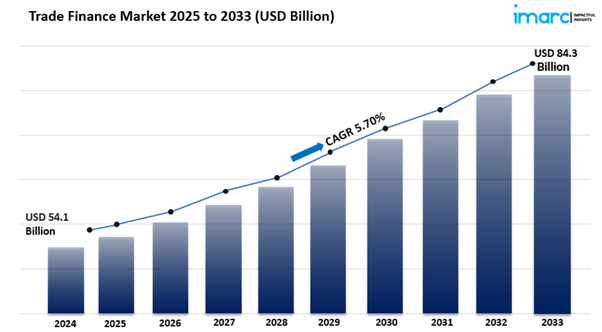

The global trade finance market size was valued at USD 54.1 billion in 2024. According to projections from the IMARC Group, this market is anticipated to grow to USD 84.3 billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.70% from 2025 to 2033.

Request to Get the Sample Report:

https://www.imarcgroup.com/trade-finance-market/requestsample

5G in the Trade Finance Market Trends

The introduction of 5G technology is poised to significantly impact the trade finance market by enhancing connectivity and enabling real-time data sharing among stakeholders. By 2025, the implementation of 5G networks will facilitate faster communication between exporters, importers, and financial institutions, streamlining the trade finance process. The increased bandwidth and reduced latency associated with 5G will allow businesses to transmit large volumes of data quickly, enabling more efficient transaction processing and documentation. For instance, trade finance providers will be able to implement real-time tracking of shipments, providing visibility into the status of goods and reducing the risk of fraud.

Additionally, 5G will enhance the capabilities of Internet of Things (IoT) devices, allowing for better monitoring of supply chains and inventory management. This connectivity will empower businesses to make data-driven decisions, optimize their operations, and respond swiftly to market changes. As the trade finance market embraces 5G technology, it is expected that the demand for innovative, efficient financial solutions will grow, driven by enhanced operational efficiency and improved customer experiences. The integration of 5G will not only transform the trade finance landscape but also pave the way for new business models and collaborative opportunities in the global marketplace.

Market Dynamics of the Trade Finance Market & Demand

Digital Transformation and Technological Advancements

The trade finance market is undergoing a profound transformation driven by digitalization and technological advancements. As businesses increasingly seek efficient solutions to manage their trade financing needs, the adoption of digital platforms and fintech solutions is on the rise. By 2025, it is expected that traditional trade finance processes will be significantly streamlined using blockchain technology, artificial intelligence (AI), and machine learning. These technologies facilitate faster transactions, reduce paperwork, and enhance transparency across the supply chain. Blockchain offers a decentralized ledger that can securely record transactions, thereby minimizing fraud and improving trust among trading partners.

Moreover, AI-driven analytics can provide valuable insights into market trends and credit risks, allowing financial institutions to make more informed lending decisions. As trade finance becomes increasingly digitized, companies that embrace these technologies will gain a competitive edge, offering faster, more reliable services to their clients. This shift towards digital trade finance solutions is likely to attract a broader range of businesses, including small and medium-sized enterprises (SMEs), which have historically faced challenges in accessing trade finance.

Growing Demand for Sustainable Trade Finance Solutions

Sustainability is emerging as a critical factor in the trade finance market, with increasing pressure on businesses to adopt environmentally friendly practices. By 2025, it is anticipated that demand for sustainable trade finance solutions will surge as companies recognize the importance of aligning their operations with global sustainability goals. Financial institutions are responding by developing products that support environmentally responsible trade practices, such as financing for green projects and sustainable supply chains. This includes offering preferential terms for businesses that demonstrate a commitment to reducing their carbon footprint or investing in renewable energy sources.

Additionally, initiatives like the Green Finance Strategy are gaining traction, encouraging banks and financial institutions to integrate environmental considerations into their trade finance offerings. As consumers and investors increasingly prioritize sustainability, companies that leverage sustainable trade finance solutions will not only enhance their brand reputation but also attract investment and customer loyalty. The convergence of sustainability and trade finance is set to reshape the market landscape, driving innovation and collaboration among stakeholders.

Increasing Geopolitical Tensions and Regulatory Changes

The trade finance market is also influenced by geopolitical tensions and evolving regulatory frameworks, which are shaping the landscape for international trade. By 2025, it is expected that trade finance will be impacted by ongoing trade disputes, tariffs, and sanctions that countries impose on one another. These factors can create uncertainty in global markets, affecting the flow of goods and the availability of financing. Financial institutions must navigate these complexities while ensuring compliance with international regulations and local laws. As a result, there is a growing need for trade finance providers to develop risk management strategies that account for geopolitical risks and regulatory changes. This includes enhancing due diligence processes, implementing robust compliance measures, and leveraging technology to monitor and assess risks in real-time.

Furthermore, as countries increasingly focus on protecting their domestic industries, trade finance solutions that adapt to these changing dynamics will be essential for businesses looking to expand internationally. The ability to effectively manage geopolitical risks will be a key differentiator for trade finance providers in the coming years.

Trade Finance Market Report Segmentation:

Breakup by Finance Type:

· Structured Trade Finance

· Supply Chain Finance

· Traditional Trade Finance

The report provides a comprehensive segmentation and analysis of the market based on finance type, which includes structured trade finance, supply chain finance, and traditional trade finance.

Breakup by Offering:

· Letters of Credit

· Bill of Lading

· Export Factoring

· Insurance

· Others

The report further offers a comprehensive segmentation and analysis of the market based on offering, covering letters of credit, bill of lading, export factoring, insurance, and others.

Breakup by Service Provider:

· Banks

· Trade Finance Houses

The report provides an in-depth segmentation and analysis of the market based on service providers, which include banks and trade finance houses. As per the report, banks accounted for the largest share of the market.

Breakup by End-User:

· Small and Medium Sized Enterprises (SMEs)

· Large Enterprises

The report provides an in-depth segmentation and analysis of the market based on end users, classifying them into small and medium-sized enterprises (SMEs) and large enterprises.

Breakup by Region:

· North America

· Asia-Pacific

· Europe

· Latin America

· Middle East and Africa

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

Competitive Landscape with Key Players:

The report provides an analysis of the competitive landscape of the trade finance market, featuring detailed profiles of the key players operating in the industry.

Some of These Key Players Include:

· Asian Development Bank

· Banco Santander SA

· Bank of America Corp.

· BNP Paribas SA

· Citigroup Inc.

· Crédit Agricole Group

· Euler Hermes

· Goldman Sachs Group Inc.

· HSBC Holdings Plc

· JPMorgan Chase & Co.

· Mitsubishi Ufj Financial Group Inc.

· Morgan Stanley

· Royal Bank of Scotland

· Standard Chartered Bank

· Wells Fargo & Co.

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=2031&flag=C

Latest News:

· April 8, 2022 — The Asian Development Bank (ADB) has partnered with Axis Bank Limited through a deal worth up to $150 million to support the expansion of supply chain financing for small and medium-sized enterprises (SMEs). Under its Trade and Supply Chain Finance Programme (TSCFP), ADB will provide guarantees on loans issued by Axis Bank, aiming to strengthen supply chain finance in key impact sectors.

· In December 2022, Mitsubishi UFJ Financial Group Inc. announced the execution of a USD 54.3 million sustainable trade finance facility for Tata Power. The financing will support the procurement of two solar power projects by TP Kirnali Limited (TPKL), a subsidiary of Tata Power. This marks Mitsubishi UFJ Financial Group Inc.'s first sustainable trade finance facility in India. The funds will be utilized by TPKL to enhance its renewable energy generation capacity.

Key Highlights of the Report:

· Market Performance (2018-2023)

· Market Outlook (2024-2032)

· Market Trends

· Market Drivers and Success Factors

· Impact of COVID-19

· Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- True & Inspiring Quotes

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- Security

- Economy/Economic

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture