United States Cyber Insurance Market Growth, Demand & Investment Forecast 2025–2033

IMARC Group has recently released a new research study titled “United States Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End Use Industry, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Cyber Insurance Market Overview

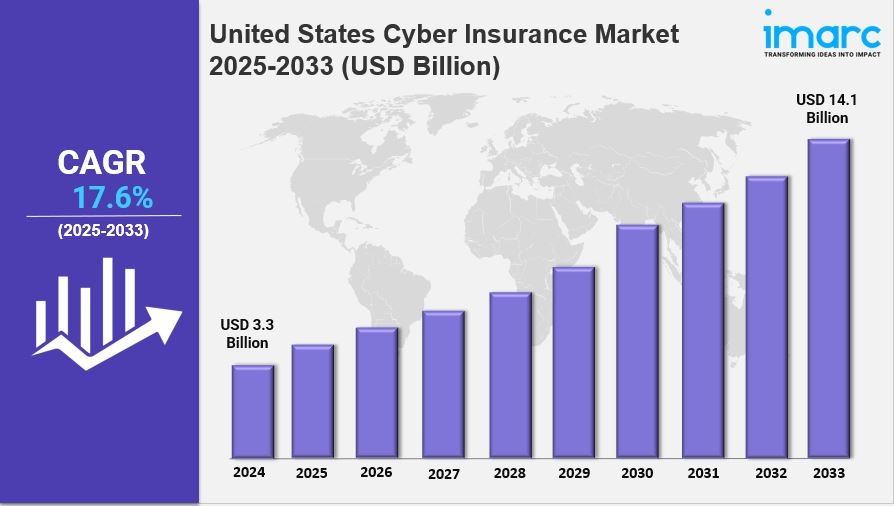

The United States cyber insurance market size was valued at USD 3.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.1 Billion by 2033, exhibiting a CAGR of 17.6% from 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years:2019-2024

Market Size in 2024: USD 3.3 Billion

Market Forecast in 2033: USD 14.1 Billion

Market Growth Rate (2025-2033): 17.6%

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-cyber-insurance-market/requestsample

Key Market Highlights:

✔️ Growing awareness of cyber risks among businesses and individuals.

✔️ Increasing regulatory requirements driving demand for comprehensive coverage.

✔️ Expansion of digital transformation initiatives leading to higher insurance uptake.

✔️ Rising frequency and sophistication of cyberattacks prompting proactive risk management.

✔️ Enhanced focus on data protection and privacy driving policy customization.

✔️ Collaboration between insurers and cybersecurity firms to improve risk assessment and mitigation strategies.

United States Cyber Insurance Market Trends and Drivers

The United States Cyber Insurance Market is experiencing significant transformation as businesses increasingly recognize the importance of safeguarding their digital assets. As cyber threats continue to evolve in complexity and frequency, organizations are turning to cyber insurance as a crucial component of their risk management strategies. This shift is not just a response to regulatory pressures but also a proactive approach to protect against potential financial losses resulting from data breaches and cyberattacks.

Market Size and Growth Dynamics

As of the latest analyses, the United States Cyber Insurance Market Size has been steadily increasing, reflecting the heightened awareness of cyber risks among various sectors. With an estimated market size projected to reach billions in the coming years, the growth trajectory is fueled by the escalating number of cyber incidents and the financial implications associated with them. Businesses are now prioritizing investments in cyber insurance to mitigate risks and ensure business continuity in the face of potential disruptions.

Share of Cyber Insurance in Risk Management

The United States Cyber Insurance Market Share is expanding as more companies recognize the value of integrating cyber insurance into their overall risk management frameworks. This trend is particularly pronounced among small and medium-sized enterprises (SMEs), which are increasingly seeking coverage to protect themselves against cyber threats that could jeopardize their operations. The competitive landscape is also evolving, with insurers offering tailored policies that cater to the specific needs of different industries, thereby enhancing the attractiveness of cyber insurance.

Future Outlook and Growth Potential

Looking ahead, the United States Cyber Insurance Market Growth is expected to accelerate as technological advancements and digital transformation initiatives continue to reshape the business environment. Companies are investing in cybersecurity measures, and as a result, the demand for comprehensive cyber insurance policies is likely to increase. Additionally, the collaboration between insurers and cybersecurity experts will further enhance policy offerings, ensuring that businesses are adequately protected against emerging threats. As the landscape evolves, organizations that prioritize cyber insurance will be better positioned to navigate the complexities of the digital age.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=10537&flag=C

The market report segments the market based on product type, distribution channel, and region:

Analysis by Component:

- Solution

- Services

Analysis by Insurance Type:

- Packaged

- Stand-alone

Analysis by Organization Type:

- Small and Medium Enterprises

- Large Enterprises

Analysis by End Use Industry:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

Regional Analysis:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- United_States_cyber_insurance_market

- United_States_cyber_insurance_market_size

- United_States_cyber_insurance_market_share

- United_States_cyber_insurance_market_trends

- United_States_cyber_insurance_market_demand

- United_States_cyber_insurance_market_growth

- United_States_cyber_insurance_market_outlook

- United_States_cyber_insurance_market_forecast

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- Security

- Economy

- Beasts of Nations

- Machine Tools-The “Mother Industry”

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture