How does America’s arms industry lobbying compare with practices in Europe, Russia, or China?

The influence of the arms industry on national defense policies varies significantly across the United States, Europe, Russia, and China.

While all these regions exhibit strong ties between defense contractors and government decision-making, the mechanisms, transparency, and outcomes differ due to political systems, institutional structures, and historical contexts.

United States: A High-Profile, Market-Driven System

In the U.S., the arms industry wields substantial influence through lobbying, campaign contributions, and the "revolving door" phenomenon, where retired military officers transition into defense contractor roles. This system is characterized by:

-

Robust Lobbying Infrastructure: In 2022, the U.S. registered 12,665 lobbyists, with defense contractors spending over $4 billion annually on lobbying efforts.

-

Political Contributions: Defense firms contribute significantly to political campaigns, ensuring access to lawmakers and influencing defense policy.

-

Revolving Door: Retired generals and admirals often become consultants or executives for defense companies, leveraging their experience and connections to advocate for specific weapons programs.

This influence has led to the continuation of programs like the F-35 Joint Strike Fighter, despite concerns over cost overruns and delays, and the approval of arms sales to regions with questionable human rights records.

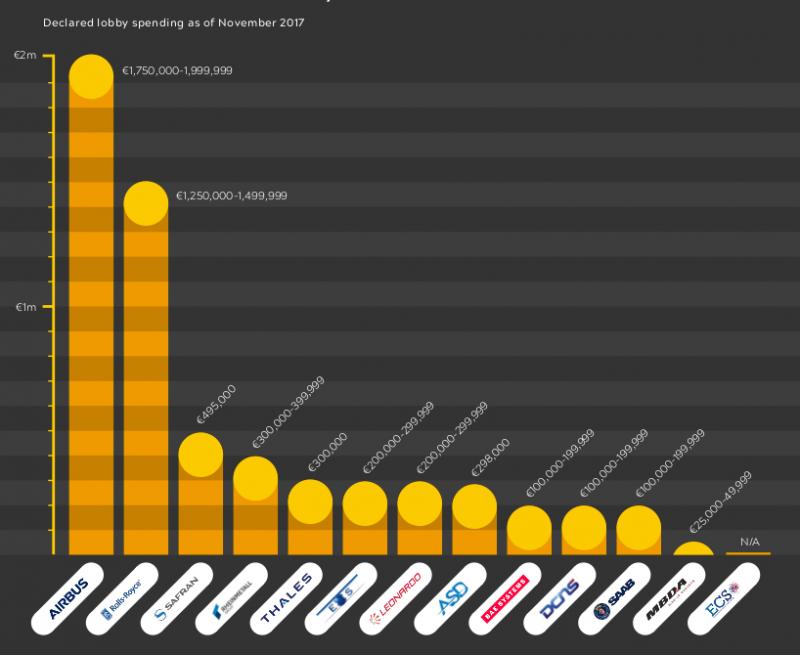

Europe: Institutionalized Influence with Strategic Autonomy Goals

In Europe, the arms industry's influence is more institutionalized, with a focus on strategic autonomy and intergovernmental cooperation:

-

EU Defense Initiatives: The European Union has established frameworks like the European Defence Investment Plan (EDIP) to enhance joint defense capabilities and reduce dependence on non-EU suppliers.

-

National Lobbying: Countries like France and Germany have strong domestic defense industries that lobby for procurement contracts, often aligning with national security objectives.

-

Transparency and Regulation: The EU has mechanisms to regulate arms exports and ensure compliance with international standards, though enforcement can vary among member states.

Despite these efforts, Europe remains heavily reliant on U.S. defense technology, with approximately 64% of arms imports by European NATO countries coming from the U.S. between 2020 and 2024.

Russia: State-Controlled Military-Industrial Complex

Russia's defense industry operates under a state-controlled model, with direct government involvement in decision-making:

-

Centralized Control: The Military-Industrial Commission (VPK), established in 2013, centralizes defense procurement and R&D decisions, reducing the need for traditional lobbying.

-

State-Owned Enterprises: Major defense companies are state-owned or heavily influenced by the government, with executives often holding government positions, facilitating direct access to policy-making.

-

Strategic Objectives: The defense industry aligns closely with national security and geopolitical strategies, with arms exports serving as tools for diplomatic influence and economic gain.

While this system minimizes the appearance of lobbying, the close ties between the military and defense industry ensure that procurement decisions align with state interests.

China: State-Directed Military-Industrial Integration

China's approach to defense procurement is characterized by state-directed integration between the military and defense industry:

-

Military-Civil Fusion: China's strategy emphasizes the integration of civilian and military sectors, facilitating the rapid development and deployment of defense technologies.

-

State-Owned Enterprises: Major defense contractors are state-owned or closely aligned with the government, with leadership often drawn from military ranks.

-

Centralized Decision-Making: The Central Military Commission oversees defense policy and procurement, with limited transparency and public input.

While traditional lobbying is less prevalent, the state's control over the defense industry ensures that procurement decisions serve national objectives, including technological advancement and military modernization.

Comparative Overview

| Region | Lobbying Mechanisms | Industry Structure | Strategic Objectives | Transparency & Regulation |

|---|---|---|---|---|

| U.S. | High-profile lobbying, campaign contributions | Private defense contractors | Market-driven, with political influence | Moderate |

| Europe | Institutionalized lobbying, intergovernmental cooperation | Mixed (private and state-owned) | Strategic autonomy, joint capabilities | High |

| Russia | Minimal traditional lobbying | State-controlled enterprises | National security and geopolitical strategy | Low |

| China | Limited traditional lobbying | State-directed integration | Military modernization, technological advancement | Very low |

While all four regions exhibit strong ties between the defense industry and government decision-making, the mechanisms and outcomes differ based on political systems and institutional structures.

The U.S. model is characterized by a market-driven approach with significant lobbying influence, whereas Europe emphasizes strategic autonomy and intergovernmental cooperation.

Russia and China maintain state-controlled systems, with direct government involvement in defense procurement and limited traditional lobbying. Understanding these differences is crucial for analyzing global defense policies and the influence of the arms industry.

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- Güvenlik

- Economy

- Beasts of Nations

- Machine Tools-The “Mother Industry”

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture