How sustainable are the Chinese loans funding Africa’s highways, ports, and power plants — and who really profits in the end?

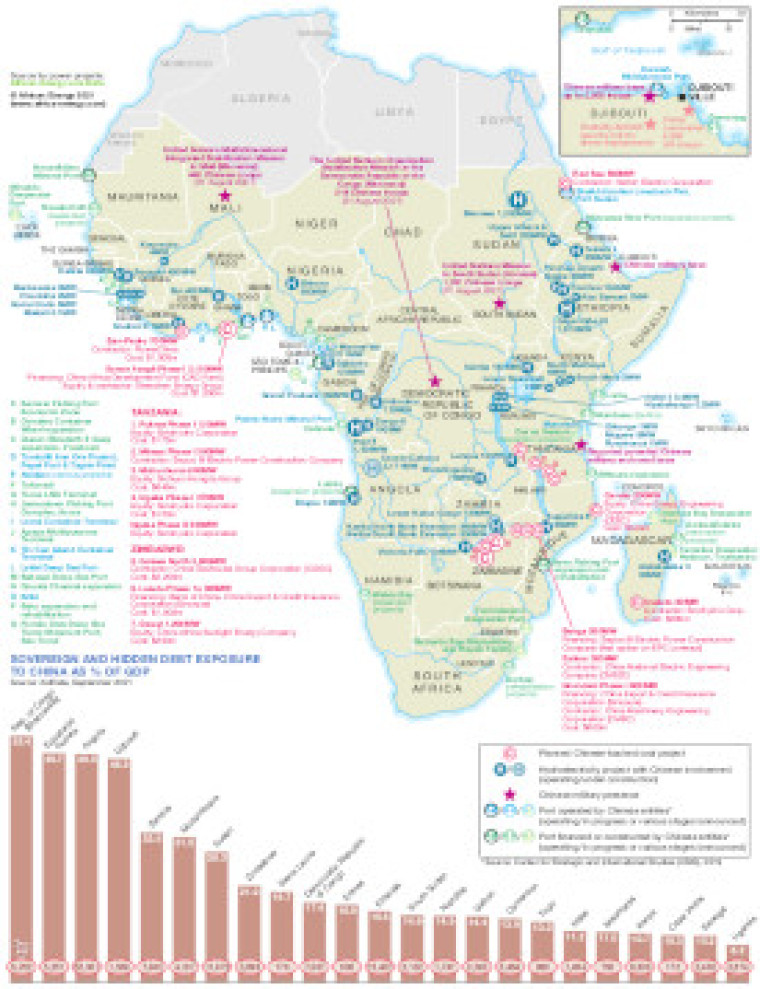

China's extensive infrastructure financing in Africa, primarily through loans for projects such as highways, ports, and power plants, has significantly shaped the continent's development landscape.

While these investments have spurred economic growth and improved connectivity, questions persist regarding their sustainability and the distribution of benefits.

The Scope and Scale of Chinese Infrastructure Financing in Africa

Between 2000 and 2023, Chinese financial institutions extended over 1,300 loans totaling approximately $182 billion to 49 African countries and seven regional organizations. These loans have predominantly funded infrastructure projects in energy, transportation, and telecommunications democracyinafrica.org. Notable examples include the Mombasa–Nairobi Standard Gauge Railway in Kenya, which received 90% of its $3.23 billion financing from the Export-Import Bank of China, and the Addis Ababa–Djibouti Railway, which was constructed with significant Chinese involvement.

Assessing the Sustainability of Chinese-Funded Infrastructure Projects

Economic Sustainability

Chinese loans often come with favorable terms, such as low-interest rates and extended repayment periods. These conditions can ease immediate financial burdens on African governments. However, the long-term economic sustainability of these projects is contingent upon their ability to generate sufficient revenue to service the debt. For instance, the Mombasa–Nairobi Railway has faced challenges in achieving projected passenger numbers, raising concerns about its financial viability.

Environmental and Social Sustainability

The environmental impact of Chinese-funded infrastructure projects varies. While some projects adhere to international environmental standards, others have faced criticism for inadequate environmental assessments and potential ecological damage. Socially, these projects can displace communities and disrupt local economies, leading to protests and social unrest in certain regions .

Who Profits from Chinese Infrastructure Investments?

Chinese Stakeholders

Chinese state-owned enterprises (SOEs) and financial institutions are the primary beneficiaries of these investments. SOEs often secure construction contracts, while financial institutions receive interest payments on loans. This arrangement ensures that a significant portion of the economic benefits flows back to China.

African Governments and Populations

African governments benefit from improved infrastructure, which can enhance economic activities and connectivity. However, the extent to which the general population benefits is mixed. In some cases, projects have led to job creation and improved services, while in others, benefits have been concentrated among elites or have not materialized as expected.

The Debt Sustainability Challenge

As of 2020, Chinese lenders accounted for approximately 12% of Africa's external debt, a figure that has grown substantially since 2000 democracyinafrica.org. The rising debt levels have raised concerns about the ability of African countries to meet repayment obligations without compromising other development priorities. Instances of debt distress have prompted calls for debt restructuring and more transparent lending practices.

Chinese loans have undeniably contributed to Africa's infrastructure development, fostering economic growth and regional integration. However, the sustainability of these projects is contingent upon careful planning, transparent governance, and inclusive benefits. For these investments to yield long-term positive outcomes, African governments must ensure that infrastructure projects are economically viable, environmentally sound, and socially equitable. Additionally, fostering local capacity and ensuring that a fair share of the benefits accrue to African populations will be crucial in transforming these loans from mere financial transactions into catalysts for sustainable development.

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- Segurança

- Economy

- Beasts of Nations

- Machine Tools-The “Mother Industry”

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture