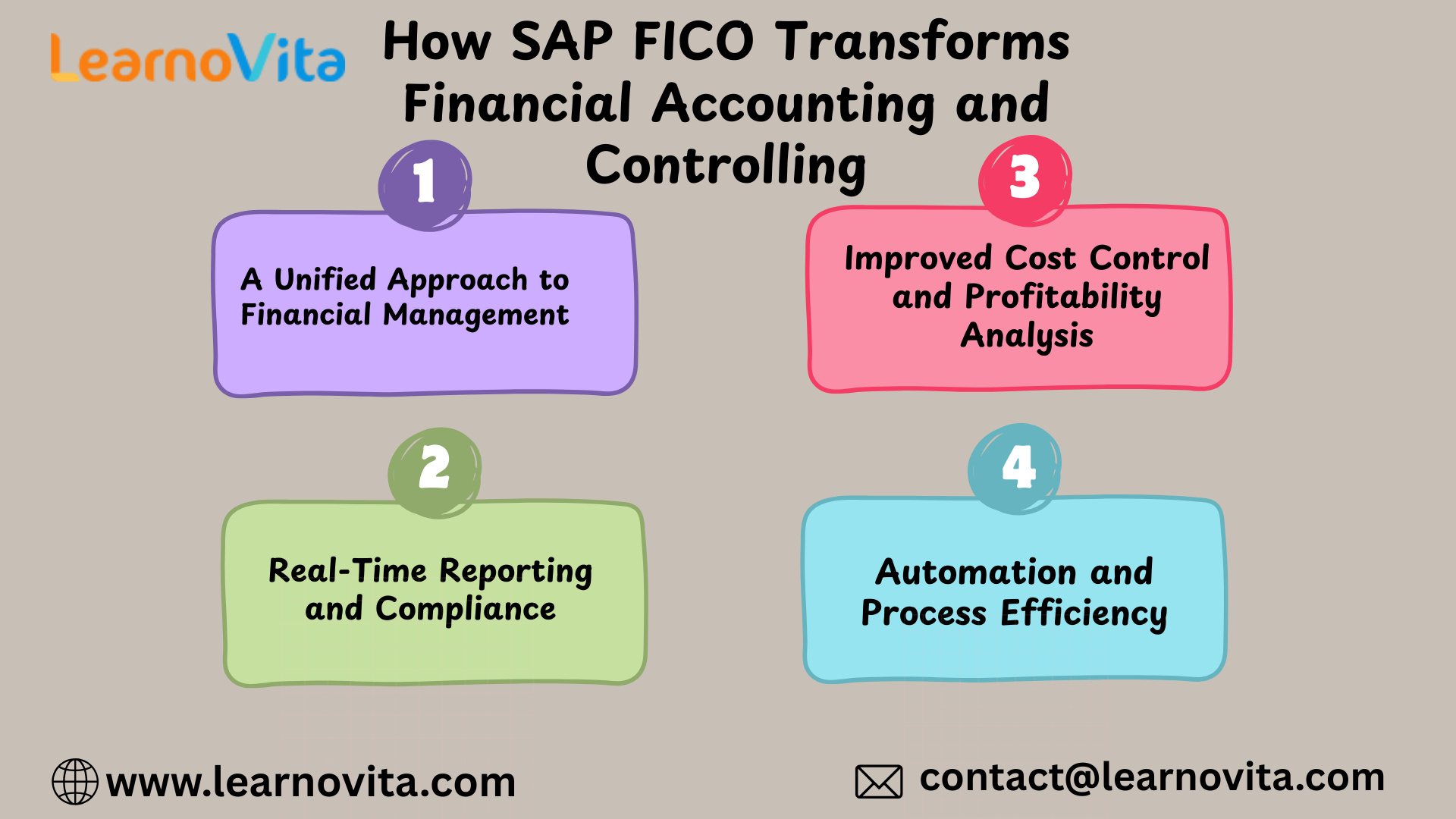

The Power of SAP FICO: Enhancing Efficiency in Accounting and Control

As businesses navigate a fast-moving digital landscape, having a reliable financial system is crucial for making smarter decisions and maintaining operational efficiency. SAP FICO, a core module within the SAP ERP suite, plays a key role in helping organizations achieve these goals. By unifying financial accounting and controlling processes, SAP FICO Course in Chennai brings clarity, accuracy, and agility to financial management.

1. A Single Platform for All Financial Activities

In many traditional setups, financial accounting and controlling function as separate units, often creating gaps in data and slowing down reporting cycles. SAP FICO bridges this divide by integrating Financial Accounting (FI) and Controlling (CO) into one cohesive platform. The FI module handles external financial processes such as ledger management, receivables, payables, and asset accounting. The CO module focuses on internal functions, including cost tracking, budgeting, and profitability assessments. Together, they deliver a unified view of financial data that supports consistency and eliminates redundant efforts.

2. Instant Financial Insights

One of the strongest advantages of SAP FICO Online Course is its ability to generate real-time financial reports. Instead of waiting for end-of-month closure, organizations can instantly view balance sheets, profit and loss statements, and cash flow summaries. This helps leadership teams react quickly, adjust strategies, and stay aligned with market demands. Compliance is also simplified. SAP FICO supports global standards like IFRS and GAAP while offering automated validation checks and audit trails. This ensures accuracy and minimizes the risks associated with regulatory reporting.

3. Stronger Cost Control and Profitability Tracking

Effective cost management is essential for long-term success, and the Controlling module delivers powerful tools for this purpose. Features such as cost center accounting, internal orders, and profitability analysis (CO-PA) allow businesses to break down expenses and revenue at a detailed level. These insights help organizations understand where costs are rising, which products or services are generating the most value, and how resources can be optimized. With data-backed clarity, decision-makers can plan more strategically and enhance overall profitability.

4. Efficiency Through Automation

SAP FICO also excels in automating repetitive financial tasks. Activities like invoice postings, reconciliations, depreciation runs, and payment processing can be automated, reducing manual work and improving accuracy. Standardized workflows further streamline approvals and financial operations, making processes faster and more reliable.

Conclusion

SAP FICO has become an essential tool for organizations aiming to modernize their financial accounting and controlling functions. By offering an integrated platform, real-time reporting capabilities, enhanced cost visibility, and powerful automation, it helps businesses operate more efficiently and make smarter decisions. In an environment where financial precision is critical, SAP FICO provides the foundation for stronger performance and sustainable growth.

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- Segurança

- Economy

- Beasts of Nations

- Machine Tools-The “Mother Industry”

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture