-

8 Yazı

-

4 Fotoğraflar

-

0 Videolar

-

Okudu EASTG saat XGClass of SDFGH

-

11/07/1980

-

Ardından: 2 people

Son Güncellemeler

-

Make Loan Processing Easier with Our End-to-End Loan Management System—Track and Manage Effortlessly.The Indian financial services sector, especially MSME lending, is witnessing a digital transformation. With increasing pressure on operational performance, transparency, and regulatory compliance, financial institutions are in urgent need of smarter back-end systems. CredAcc’s Loan management system is emerging as the go-to solution for banks and NBFCs looking to manage their loan...0 Yorumlar 0 hisse senetleri 1K Views 0 önizlemePlease log in to like, share and comment!

-

The smart way to launch MSME loans is with a Loan origination system that requires no code and no tech ops.In the rapidly evolving world of digital finance, speed, accuracy, and adaptability are more important than ever—especially when it comes to MSME loan origination. Traditional lending processes are often slow, fragmented, and costly, delaying crucial funds to small businesses that need them quickly. This is where CredAcc’s next-generation Loan origination system comes in—a...0 Yorumlar 0 hisse senetleri 1K Views 0 önizleme

-

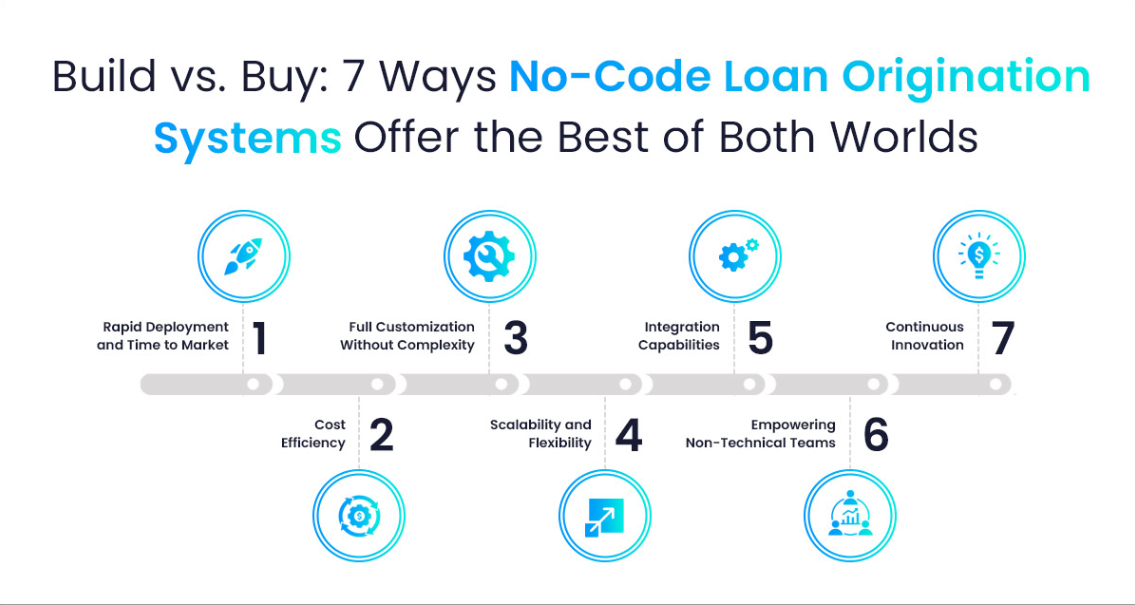

Fast-track MSME loan disbursement with an easy-to-deploy Loan origination system—CredAcc’s no-code platform keeps it quick and affordable.

CredAcc’s no-code Loan origination system offers an innovative solution for MSME lending, simplifying the way banks and NBFCs process loans. By eliminating the need for complex coding, the platform empowers non-technical teams to design and manage loan workflows with ease. Financial institutions can quickly respond to market demands and regulatory changes without waiting for months of development. The Loan origination system is designed to be flexible, allowing for customization based on the institution’s specific needs. It reduces errors, speeds up processing, and ultimately enhances customer satisfaction. Whether you're a small NBFC or a large bank, CredAcc's system can scale with your business.

Visit for more info :- https://www.credacc.com/loan-origination-systemFast-track MSME loan disbursement with an easy-to-deploy Loan origination system—CredAcc’s no-code platform keeps it quick and affordable. CredAcc’s no-code Loan origination system offers an innovative solution for MSME lending, simplifying the way banks and NBFCs process loans. By eliminating the need for complex coding, the platform empowers non-technical teams to design and manage loan workflows with ease. Financial institutions can quickly respond to market demands and regulatory changes without waiting for months of development. The Loan origination system is designed to be flexible, allowing for customization based on the institution’s specific needs. It reduces errors, speeds up processing, and ultimately enhances customer satisfaction. Whether you're a small NBFC or a large bank, CredAcc's system can scale with your business. Visit for more info :- https://www.credacc.com/loan-origination-system0 Yorumlar 0 hisse senetleri 881 Views 0 önizleme -

Save your dev team for later—launch MSME loans now with a no-code Loan origination system by CredAcc.

By leveraging CredAcc’s no-code Loan origination system, banks and NBFCs can simplify the MSME lending process and offer loans more efficiently. The system automates time-consuming tasks such as document verification, eligibility checks, and loan approvals, allowing financial institutions to process loans faster and with fewer errors. Designed with user-friendliness in mind, the platform requires no technical skills, enabling banks and NBFCs to launch new loan products quickly and efficiently. CredAcc helps financial institutions stay competitive and provide better service to their MSME customers.

Visit for more info :- https://www.credacc.com/loan-origination-systemSave your dev team for later—launch MSME loans now with a no-code Loan origination system by CredAcc. By leveraging CredAcc’s no-code Loan origination system, banks and NBFCs can simplify the MSME lending process and offer loans more efficiently. The system automates time-consuming tasks such as document verification, eligibility checks, and loan approvals, allowing financial institutions to process loans faster and with fewer errors. Designed with user-friendliness in mind, the platform requires no technical skills, enabling banks and NBFCs to launch new loan products quickly and efficiently. CredAcc helps financial institutions stay competitive and provide better service to their MSME customers. Visit for more info :- https://www.credacc.com/loan-origination-system0 Yorumlar 0 hisse senetleri 1K Views 0 önizleme -

CredAcc Loan Management System – Secure and Efficient MSME Loan Servicing and Payments with API-Based Integration for Banks.Effective loan management is critical for financial institutions, and CredAcc’s Loan Management System provides a comprehensive solution. Designed for Indian banks and NBFCs, this advanced platform automates loan servicing, repayment tracking, and collections. Its flexible configuration and secure API-first architecture allow seamless integration with existing banking systems, ensuring...0 Yorumlar 0 hisse senetleri 2K Views 0 önizleme

-

CredAcc’s Loan Management System – Streamline MSME Loan Servicing with Secure and Fast API-Based Solutions.

Boost your loan management efficiency with CredAcc’s cutting-edge Loan Management System. Designed for Indian banks and NBFCs, this API-first solution simplifies MSME loan servicing, collections, and payments post-disbursal. The system’s automation capabilities reduce manual work and increase accuracy, ensuring faster processing and timely payments. CredAcc’s Loan Management System integrates seamlessly with your financial infrastructure, providing real-time insights and customizable repayment options. Its secure platform ensures data protection and compliance with regulatory requirements. Enhance your loan management capabilities and provide better service to your clients with CredAcc’s reliable solution.

Visit for more info :- https://www.credacc.com/loan-management-systemCredAcc’s Loan Management System – Streamline MSME Loan Servicing with Secure and Fast API-Based Solutions. Boost your loan management efficiency with CredAcc’s cutting-edge Loan Management System. Designed for Indian banks and NBFCs, this API-first solution simplifies MSME loan servicing, collections, and payments post-disbursal. The system’s automation capabilities reduce manual work and increase accuracy, ensuring faster processing and timely payments. CredAcc’s Loan Management System integrates seamlessly with your financial infrastructure, providing real-time insights and customizable repayment options. Its secure platform ensures data protection and compliance with regulatory requirements. Enhance your loan management capabilities and provide better service to your clients with CredAcc’s reliable solution. Visit for more info :- https://www.credacc.com/loan-management-system0 Yorumlar 0 hisse senetleri 1K Views 0 önizleme -

Optimize MSME Loan Handling with CredAcc’s Secure Loan Management System for Banks and Financial Institutions.

CredAcc’s Loan Management System delivers a seamless solution for MSME loan management. This API-first platform automates loan servicing, collections, and payments for Indian banks and NBFCs. The system’s real-time data synchronization and customizable repayment options improve loan performance and reduce errors. CredAcc’s Loan Management System integrates with existing systems, ensuring smooth data flow and accurate reporting. Its secure infrastructure protects sensitive information and ensures regulatory compliance. Optimize your loan management strategy and enhance customer satisfaction with CredAcc’s powerful solution.

Visit for more info :- https://www.credacc.com/loan-management-systemOptimize MSME Loan Handling with CredAcc’s Secure Loan Management System for Banks and Financial Institutions. CredAcc’s Loan Management System delivers a seamless solution for MSME loan management. This API-first platform automates loan servicing, collections, and payments for Indian banks and NBFCs. The system’s real-time data synchronization and customizable repayment options improve loan performance and reduce errors. CredAcc’s Loan Management System integrates with existing systems, ensuring smooth data flow and accurate reporting. Its secure infrastructure protects sensitive information and ensures regulatory compliance. Optimize your loan management strategy and enhance customer satisfaction with CredAcc’s powerful solution. Visit for more info :- https://www.credacc.com/loan-management-system0 Yorumlar 0 hisse senetleri 1K Views 0 önizleme -

0 Yorumlar 0 hisse senetleri 458 Views 0 önizleme

Daha Hikayeler

Sponsorluk