: Discover the comprehensive Investment Advisor Certification (IAC) program at CIFA, designed to equip aspiring financial professionals with essential knowledge in UK regulations, investment strategies, risk management, taxation, and derivatives.

https://cifa.ac/home/bundle/Investment-Advisor-Certification-IAC/7

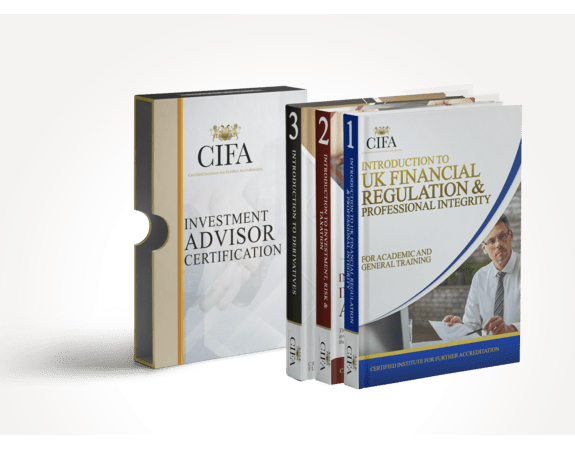

In today's dynamic financial landscape, obtaining a robust certification is pivotal for those aiming to excel as investment advisors. The Certified Institute for Further Accreditation (CIFA) offers the Investment Advisor Certification (IAC), a meticulously designed program that provides a solid foundation in key areas essential for success in the financial services industry.

Program Overview

The IAC program is structured into three comprehensive units, each focusing on critical aspects of investment advising:

Introduction to UK Financial Regulation and Professional Integrity

This unit delves into the UK's financial regulatory framework, encompassing the roles of regulatory bodies such as the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). Participants will explore compliance standards, legal frameworks, and the significance of ethical conduct in maintaining trust within the financial sector.

CIFA.AC

Introduction to Investment, Risk, and Taxation

Focusing on investment principles, this unit covers various asset classes, risk assessment methodologies, and tax implications. Learners will gain insights into portfolio construction, investment strategies, and the impact of macroeconomic factors on investment decisions.

CIFA.AC

Introduction to Derivatives

This unit provides a thorough understanding of derivative instruments, including futures, options, swaps, and forward contracts. Participants will learn about the pricing, trading, and application of derivatives in risk management and investment strategies.

CIFA.AC

Key Learning Outcomes

Upon completing the IAC program, participants will:

Understand Regulatory Frameworks: Gain a comprehensive understanding of UK financial regulations and the roles of key regulatory bodies.

Uphold Professional Integrity: Recognize the importance of ethical conduct and its application in client relationships and financial transactions.

Manage Investment Risks: Develop strategies to identify, assess, and mitigate various investment risks effectively.

Navigate Taxation in Investments: Acquire knowledge of tax-efficient investment strategies and the impact of taxation on investment decisions.

Utilize Derivative Instruments: Understand the function and application of derivatives in modern financial markets.

Who Should Enroll?

The IAC program is ideal for:

Aspiring investment professionals seeking foundational knowledge.

Finance graduates aiming to enhance their credentials.

Financial advisors and planners desiring to broaden their expertise.

Banking and investment professionals pursuing career advancement.

Individuals considering a career change into the financial sector.

Regulatory compliance officers needing a deeper understanding of investment advising.

Certification and Accreditation

Upon successful completion of the program and passing the requisite examinations, participants will receive a digital certificate accredited by the CPD Certification Service. This certification attests to the individual's proficiency and commitment to ongoing professional development in the financial services industry.

: Discover the comprehensive Investment Advisor Certification (IAC) program at CIFA, designed to equip aspiring financial professionals with essential knowledge in UK regulations, investment strategies, risk management, taxation, and derivatives.

https://cifa.ac/home/bundle/Investment-Advisor-Certification-IAC/7

In today's dynamic financial landscape, obtaining a robust certification is pivotal for those aiming to excel as investment advisors. The Certified Institute for Further Accreditation (CIFA) offers the Investment Advisor Certification (IAC), a meticulously designed program that provides a solid foundation in key areas essential for success in the financial services industry.

Program Overview

The IAC program is structured into three comprehensive units, each focusing on critical aspects of investment advising:

Introduction to UK Financial Regulation and Professional Integrity

This unit delves into the UK's financial regulatory framework, encompassing the roles of regulatory bodies such as the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). Participants will explore compliance standards, legal frameworks, and the significance of ethical conduct in maintaining trust within the financial sector.

CIFA.AC

Introduction to Investment, Risk, and Taxation

Focusing on investment principles, this unit covers various asset classes, risk assessment methodologies, and tax implications. Learners will gain insights into portfolio construction, investment strategies, and the impact of macroeconomic factors on investment decisions.

CIFA.AC

Introduction to Derivatives

This unit provides a thorough understanding of derivative instruments, including futures, options, swaps, and forward contracts. Participants will learn about the pricing, trading, and application of derivatives in risk management and investment strategies.

CIFA.AC

Key Learning Outcomes

Upon completing the IAC program, participants will:

Understand Regulatory Frameworks: Gain a comprehensive understanding of UK financial regulations and the roles of key regulatory bodies.

Uphold Professional Integrity: Recognize the importance of ethical conduct and its application in client relationships and financial transactions.

Manage Investment Risks: Develop strategies to identify, assess, and mitigate various investment risks effectively.

Navigate Taxation in Investments: Acquire knowledge of tax-efficient investment strategies and the impact of taxation on investment decisions.

Utilize Derivative Instruments: Understand the function and application of derivatives in modern financial markets.

Who Should Enroll?

The IAC program is ideal for:

Aspiring investment professionals seeking foundational knowledge.

Finance graduates aiming to enhance their credentials.

Financial advisors and planners desiring to broaden their expertise.

Banking and investment professionals pursuing career advancement.

Individuals considering a career change into the financial sector.

Regulatory compliance officers needing a deeper understanding of investment advising.

Certification and Accreditation

Upon successful completion of the program and passing the requisite examinations, participants will receive a digital certificate accredited by the CPD Certification Service. This certification attests to the individual's proficiency and commitment to ongoing professional development in the financial services industry.