How can banks and online platforms detect and prevent fraud in real-time?

Banks and online platforms are at the forefront of the battle against cyber fraud, and real-time detection and prevention are crucial given the speed at which illicit transactions and deceptive communications can occur. They employ a combination of sophisticated technologies, data analysis, and operational processes.

Here's how they detect and prevent fraud in real-time:

I. Leveraging Artificial Intelligence (AI) and Machine Learning (ML)

This is the cornerstone of modern real-time fraud detection. AI/ML models can process vast amounts of data in milliseconds, identify complex patterns, and adapt to evolving fraud tactics.

Behavioral Analytics:

User Profiling: AI systems create a comprehensive profile of a user's normal behavior, including typical login times, devices used, geographic locations, transaction amounts, frequency, spending habits, and even typing patterns or mouse movements (behavioral biometrics).

Anomaly Detection: Any significant deviation from this established baseline (e.g., a login from a new device or unusual location, a large transaction to a new beneficiary, multiple failed login attempts followed by a success) triggers an immediate alert or a "step-up" authentication challenge.

Examples: A bank might flag a transaction if a customer who normally spends small amounts in Taipei suddenly attempts a large international transfer from a location like Nigeria or Cambodia.

Pattern Recognition:

Fraud Typologies: ML models are trained on massive datasets of both legitimate and known fraudulent transactions, enabling them to recognize subtle patterns indicative of fraud. This includes identifying "smurfing" (multiple small transactions to avoid detection) or links between seemingly unrelated accounts.

Adaptive Learning: Unlike traditional rule-based systems, AI models continuously learn from new data, including newly identified fraud cases, allowing them to adapt to evolving scam techniques (e.g., new phishing email patterns, synthetic identity fraud).

Real-time Scoring and Risk Assessment:

Every transaction, login attempt, or user action is immediately assigned a risk score based on hundreds, or even thousands, of variables analyzed by AI/ML models.

This score determines the immediate response: approve, block, flag for manual review, or request additional verification.

Generative AI:

Emerging use of generative AI to identify fraud that mimics human behavior. By generating synthetic data that models legitimate and fraudulent patterns, it helps train more robust detection systems.

Conversely, generative AI is also used by fraudsters (e.g., deepfakes, sophisticated phishing), necessitating continuous updates to detection models.

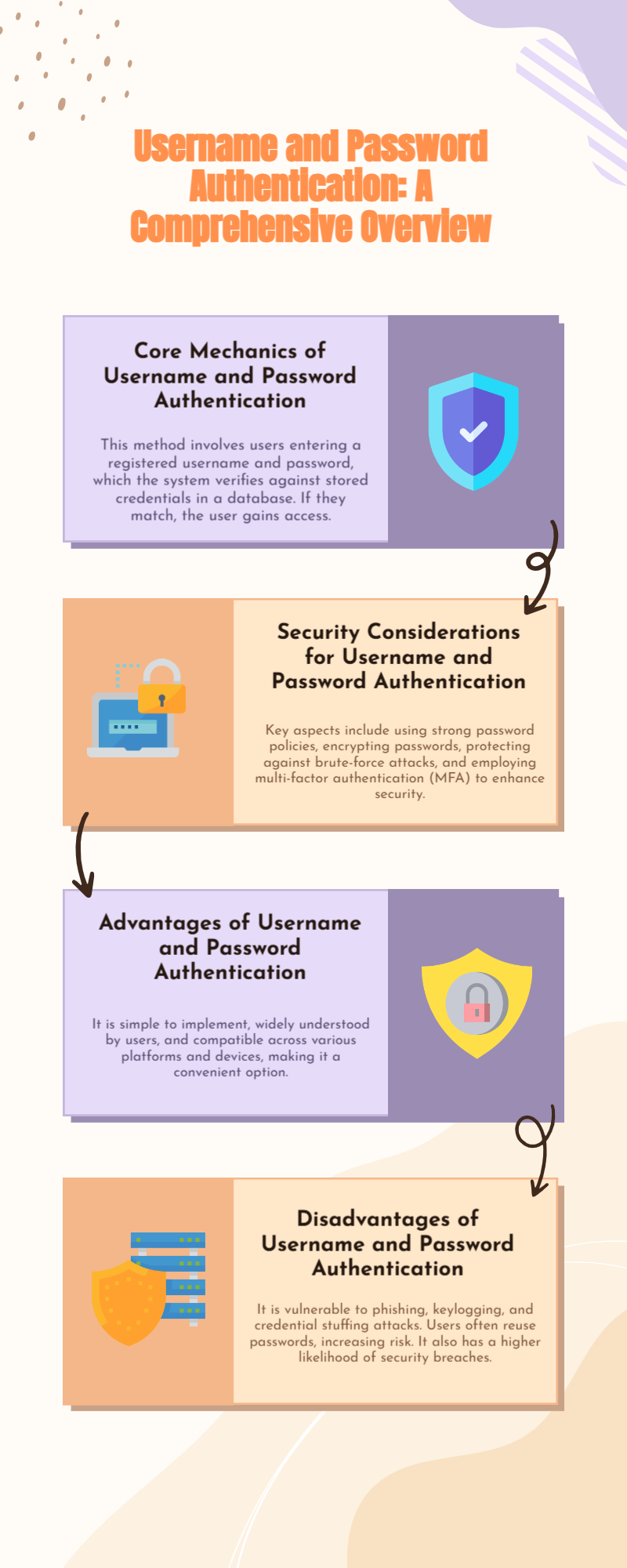

II. Multi-Layered Authentication and Verification

Even with AI, strong authentication is critical to prevent account takeovers.

Multi-Factor Authentication (MFA/2FA):

Requires users to verify their identity using at least two different factors (e.g., something they know like a password, something they have like a phone or hardware token, something they are like a fingerprint or face scan).

Risk-Based Authentication: Stricter MFA is applied only when suspicious activity is detected (e.g., login from a new device, high-value transaction). For instance, in Taiwan, many banks require an additional OTP for certain online transactions.

Device Fingerprinting:

Identifies and tracks specific devices (computers, smartphones) used to access accounts. If an unrecognized device attempts to log in, it can trigger an alert or an MFA challenge.

Biometric Verification:

Fingerprint, facial recognition (e.g., Face ID), or voice authentication, especially for mobile banking apps, provides a secure and convenient layer of identity verification.

3D Secure 2.0 (3DS2):

An enhanced authentication protocol for online card transactions. It uses more data points to assess transaction risk in real-time, often without requiring the user to enter a password, minimizing friction while increasing security.

Address Verification Service (AVS) & Card Verification Value (CVV):

Traditional but still vital tools used by payment gateways to verify the billing address and the three/four-digit security code on the card.

III. Data Monitoring and Intelligence Sharing

Transaction Monitoring:

Automated systems continuously monitor all transactions (deposits, withdrawals, transfers, payments) for suspicious patterns, amounts, or destinations.

Real-time Event Streaming:

Utilizing technologies like Apache Kafka to ingest and process massive streams of data from various sources (login attempts, transactions, API calls) in real-time for immediate analysis.

Threat Intelligence Feeds:

Banks and platforms subscribe to and share intelligence on emerging fraud typologies, known malicious IP addresses, fraudulent phone numbers, compromised credentials, and scam tactics (e.g., lists of fake investment websites or scam social media profiles). This helps them proactively block or flag threats.

Collaboration with Law Enforcement: In Taiwan, banks and online platforms are increasingly mandated to collaborate with the 165 Anti-Fraud Hotline and law enforcement to share information about fraud cases and fraudulent accounts.

KYC (Know Your Customer) and AML (Anti-Money Laundering) Checks:

While not strictly real-time fraud detection, robust KYC processes during onboarding (identity verification) and continuous AML transaction monitoring are crucial for preventing fraudsters from opening accounts in the first place or laundering money once fraud has occurred. Taiwan's recent emphasis on VASP AML regulations is a key step.

IV. Operational Procedures and Human Oversight

Automated Responses:

Based on risk scores, systems can automatically:

Block Transactions: For high-risk activities.

Challenge Users: Request additional authentication.

Send Alerts: Notify the user via SMS or email about suspicious activity.

Temporarily Lock Accounts: To prevent further compromise.

Human Fraud Analysts:

AI/ML systems identify suspicious activities, but complex or borderline cases are escalated to human fraud analysts for manual review. These analysts use their experience and judgment to make final decisions.

They also investigate new fraud patterns that the AI might not yet be trained on.

Customer Education:

Banks and platforms actively educate their users about common scam tactics (e.g., investment scams, phishing, impersonation scams) through apps, websites, SMS alerts, and public campaigns (e.g., Taiwan's 165 hotline campaigns). This empowers users to be the "first line of defense."

Dedicated Fraud Prevention Teams:

Specialized teams are responsible for developing, implementing, and continually optimizing fraud prevention strategies, including updating risk rules and ML models.

By integrating these advanced technologies and proactive operational measures, banks and and online platforms strive to detect and prevent fraud in real-time, reducing financial losses and enhancing customer trust. However, the cat-and-mouse game with fraudsters means constant adaptation and investment are required.

Banks and online platforms are at the forefront of the battle against cyber fraud, and real-time detection and prevention are crucial given the speed at which illicit transactions and deceptive communications can occur. They employ a combination of sophisticated technologies, data analysis, and operational processes.

Here's how they detect and prevent fraud in real-time:

I. Leveraging Artificial Intelligence (AI) and Machine Learning (ML)

This is the cornerstone of modern real-time fraud detection. AI/ML models can process vast amounts of data in milliseconds, identify complex patterns, and adapt to evolving fraud tactics.

Behavioral Analytics:

User Profiling: AI systems create a comprehensive profile of a user's normal behavior, including typical login times, devices used, geographic locations, transaction amounts, frequency, spending habits, and even typing patterns or mouse movements (behavioral biometrics).

Anomaly Detection: Any significant deviation from this established baseline (e.g., a login from a new device or unusual location, a large transaction to a new beneficiary, multiple failed login attempts followed by a success) triggers an immediate alert or a "step-up" authentication challenge.

Examples: A bank might flag a transaction if a customer who normally spends small amounts in Taipei suddenly attempts a large international transfer from a location like Nigeria or Cambodia.

Pattern Recognition:

Fraud Typologies: ML models are trained on massive datasets of both legitimate and known fraudulent transactions, enabling them to recognize subtle patterns indicative of fraud. This includes identifying "smurfing" (multiple small transactions to avoid detection) or links between seemingly unrelated accounts.

Adaptive Learning: Unlike traditional rule-based systems, AI models continuously learn from new data, including newly identified fraud cases, allowing them to adapt to evolving scam techniques (e.g., new phishing email patterns, synthetic identity fraud).

Real-time Scoring and Risk Assessment:

Every transaction, login attempt, or user action is immediately assigned a risk score based on hundreds, or even thousands, of variables analyzed by AI/ML models.

This score determines the immediate response: approve, block, flag for manual review, or request additional verification.

Generative AI:

Emerging use of generative AI to identify fraud that mimics human behavior. By generating synthetic data that models legitimate and fraudulent patterns, it helps train more robust detection systems.

Conversely, generative AI is also used by fraudsters (e.g., deepfakes, sophisticated phishing), necessitating continuous updates to detection models.

II. Multi-Layered Authentication and Verification

Even with AI, strong authentication is critical to prevent account takeovers.

Multi-Factor Authentication (MFA/2FA):

Requires users to verify their identity using at least two different factors (e.g., something they know like a password, something they have like a phone or hardware token, something they are like a fingerprint or face scan).

Risk-Based Authentication: Stricter MFA is applied only when suspicious activity is detected (e.g., login from a new device, high-value transaction). For instance, in Taiwan, many banks require an additional OTP for certain online transactions.

Device Fingerprinting:

Identifies and tracks specific devices (computers, smartphones) used to access accounts. If an unrecognized device attempts to log in, it can trigger an alert or an MFA challenge.

Biometric Verification:

Fingerprint, facial recognition (e.g., Face ID), or voice authentication, especially for mobile banking apps, provides a secure and convenient layer of identity verification.

3D Secure 2.0 (3DS2):

An enhanced authentication protocol for online card transactions. It uses more data points to assess transaction risk in real-time, often without requiring the user to enter a password, minimizing friction while increasing security.

Address Verification Service (AVS) & Card Verification Value (CVV):

Traditional but still vital tools used by payment gateways to verify the billing address and the three/four-digit security code on the card.

III. Data Monitoring and Intelligence Sharing

Transaction Monitoring:

Automated systems continuously monitor all transactions (deposits, withdrawals, transfers, payments) for suspicious patterns, amounts, or destinations.

Real-time Event Streaming:

Utilizing technologies like Apache Kafka to ingest and process massive streams of data from various sources (login attempts, transactions, API calls) in real-time for immediate analysis.

Threat Intelligence Feeds:

Banks and platforms subscribe to and share intelligence on emerging fraud typologies, known malicious IP addresses, fraudulent phone numbers, compromised credentials, and scam tactics (e.g., lists of fake investment websites or scam social media profiles). This helps them proactively block or flag threats.

Collaboration with Law Enforcement: In Taiwan, banks and online platforms are increasingly mandated to collaborate with the 165 Anti-Fraud Hotline and law enforcement to share information about fraud cases and fraudulent accounts.

KYC (Know Your Customer) and AML (Anti-Money Laundering) Checks:

While not strictly real-time fraud detection, robust KYC processes during onboarding (identity verification) and continuous AML transaction monitoring are crucial for preventing fraudsters from opening accounts in the first place or laundering money once fraud has occurred. Taiwan's recent emphasis on VASP AML regulations is a key step.

IV. Operational Procedures and Human Oversight

Automated Responses:

Based on risk scores, systems can automatically:

Block Transactions: For high-risk activities.

Challenge Users: Request additional authentication.

Send Alerts: Notify the user via SMS or email about suspicious activity.

Temporarily Lock Accounts: To prevent further compromise.

Human Fraud Analysts:

AI/ML systems identify suspicious activities, but complex or borderline cases are escalated to human fraud analysts for manual review. These analysts use their experience and judgment to make final decisions.

They also investigate new fraud patterns that the AI might not yet be trained on.

Customer Education:

Banks and platforms actively educate their users about common scam tactics (e.g., investment scams, phishing, impersonation scams) through apps, websites, SMS alerts, and public campaigns (e.g., Taiwan's 165 hotline campaigns). This empowers users to be the "first line of defense."

Dedicated Fraud Prevention Teams:

Specialized teams are responsible for developing, implementing, and continually optimizing fraud prevention strategies, including updating risk rules and ML models.

By integrating these advanced technologies and proactive operational measures, banks and and online platforms strive to detect and prevent fraud in real-time, reducing financial losses and enhancing customer trust. However, the cat-and-mouse game with fraudsters means constant adaptation and investment are required.

How can banks and online platforms detect and prevent fraud in real-time?

Banks and online platforms are at the forefront of the battle against cyber fraud, and real-time detection and prevention are crucial given the speed at which illicit transactions and deceptive communications can occur. They employ a combination of sophisticated technologies, data analysis, and operational processes.

Here's how they detect and prevent fraud in real-time:

I. Leveraging Artificial Intelligence (AI) and Machine Learning (ML)

This is the cornerstone of modern real-time fraud detection. AI/ML models can process vast amounts of data in milliseconds, identify complex patterns, and adapt to evolving fraud tactics.

Behavioral Analytics:

User Profiling: AI systems create a comprehensive profile of a user's normal behavior, including typical login times, devices used, geographic locations, transaction amounts, frequency, spending habits, and even typing patterns or mouse movements (behavioral biometrics).

Anomaly Detection: Any significant deviation from this established baseline (e.g., a login from a new device or unusual location, a large transaction to a new beneficiary, multiple failed login attempts followed by a success) triggers an immediate alert or a "step-up" authentication challenge.

Examples: A bank might flag a transaction if a customer who normally spends small amounts in Taipei suddenly attempts a large international transfer from a location like Nigeria or Cambodia.

Pattern Recognition:

Fraud Typologies: ML models are trained on massive datasets of both legitimate and known fraudulent transactions, enabling them to recognize subtle patterns indicative of fraud. This includes identifying "smurfing" (multiple small transactions to avoid detection) or links between seemingly unrelated accounts.

Adaptive Learning: Unlike traditional rule-based systems, AI models continuously learn from new data, including newly identified fraud cases, allowing them to adapt to evolving scam techniques (e.g., new phishing email patterns, synthetic identity fraud).

Real-time Scoring and Risk Assessment:

Every transaction, login attempt, or user action is immediately assigned a risk score based on hundreds, or even thousands, of variables analyzed by AI/ML models.

This score determines the immediate response: approve, block, flag for manual review, or request additional verification.

Generative AI:

Emerging use of generative AI to identify fraud that mimics human behavior. By generating synthetic data that models legitimate and fraudulent patterns, it helps train more robust detection systems.

Conversely, generative AI is also used by fraudsters (e.g., deepfakes, sophisticated phishing), necessitating continuous updates to detection models.

II. Multi-Layered Authentication and Verification

Even with AI, strong authentication is critical to prevent account takeovers.

Multi-Factor Authentication (MFA/2FA):

Requires users to verify their identity using at least two different factors (e.g., something they know like a password, something they have like a phone or hardware token, something they are like a fingerprint or face scan).

Risk-Based Authentication: Stricter MFA is applied only when suspicious activity is detected (e.g., login from a new device, high-value transaction). For instance, in Taiwan, many banks require an additional OTP for certain online transactions.

Device Fingerprinting:

Identifies and tracks specific devices (computers, smartphones) used to access accounts. If an unrecognized device attempts to log in, it can trigger an alert or an MFA challenge.

Biometric Verification:

Fingerprint, facial recognition (e.g., Face ID), or voice authentication, especially for mobile banking apps, provides a secure and convenient layer of identity verification.

3D Secure 2.0 (3DS2):

An enhanced authentication protocol for online card transactions. It uses more data points to assess transaction risk in real-time, often without requiring the user to enter a password, minimizing friction while increasing security.

Address Verification Service (AVS) & Card Verification Value (CVV):

Traditional but still vital tools used by payment gateways to verify the billing address and the three/four-digit security code on the card.

III. Data Monitoring and Intelligence Sharing

Transaction Monitoring:

Automated systems continuously monitor all transactions (deposits, withdrawals, transfers, payments) for suspicious patterns, amounts, or destinations.

Real-time Event Streaming:

Utilizing technologies like Apache Kafka to ingest and process massive streams of data from various sources (login attempts, transactions, API calls) in real-time for immediate analysis.

Threat Intelligence Feeds:

Banks and platforms subscribe to and share intelligence on emerging fraud typologies, known malicious IP addresses, fraudulent phone numbers, compromised credentials, and scam tactics (e.g., lists of fake investment websites or scam social media profiles). This helps them proactively block or flag threats.

Collaboration with Law Enforcement: In Taiwan, banks and online platforms are increasingly mandated to collaborate with the 165 Anti-Fraud Hotline and law enforcement to share information about fraud cases and fraudulent accounts.

KYC (Know Your Customer) and AML (Anti-Money Laundering) Checks:

While not strictly real-time fraud detection, robust KYC processes during onboarding (identity verification) and continuous AML transaction monitoring are crucial for preventing fraudsters from opening accounts in the first place or laundering money once fraud has occurred. Taiwan's recent emphasis on VASP AML regulations is a key step.

IV. Operational Procedures and Human Oversight

Automated Responses:

Based on risk scores, systems can automatically:

Block Transactions: For high-risk activities.

Challenge Users: Request additional authentication.

Send Alerts: Notify the user via SMS or email about suspicious activity.

Temporarily Lock Accounts: To prevent further compromise.

Human Fraud Analysts:

AI/ML systems identify suspicious activities, but complex or borderline cases are escalated to human fraud analysts for manual review. These analysts use their experience and judgment to make final decisions.

They also investigate new fraud patterns that the AI might not yet be trained on.

Customer Education:

Banks and platforms actively educate their users about common scam tactics (e.g., investment scams, phishing, impersonation scams) through apps, websites, SMS alerts, and public campaigns (e.g., Taiwan's 165 hotline campaigns). This empowers users to be the "first line of defense."

Dedicated Fraud Prevention Teams:

Specialized teams are responsible for developing, implementing, and continually optimizing fraud prevention strategies, including updating risk rules and ML models.

By integrating these advanced technologies and proactive operational measures, banks and and online platforms strive to detect and prevent fraud in real-time, reducing financial losses and enhancing customer trust. However, the cat-and-mouse game with fraudsters means constant adaptation and investment are required.

0 Commentarii

0 Distribuiri

6K Views

0 previzualizare