SUPPLY CHAIN TIMELINE: China’s Rise in Global Trade & Supply Chain Power.

Year | Key Event | Impact

1978 | Deng Xiaoping launches "Reform and Opening Up" | Shift from planned economy to market reforms; welcomes foreign investment.

1980s | Special Economic Zones (e.g., Shenzhen) established | Factories explode in growth, becoming hubs for global export.

1990s | Explosive growth in textiles, toys, electronics | Western companies begin outsourcing en masse to cut costs.

2001 | Joined WTO (World Trade Organization) | China gets full access to global markets — boom in exports.

2000s | "Factory of the World" status | Apple, Nike, Walmart and others shift most production to China.

2010s | Moves up the value chain (tech, EVs, solar) | No longer just cheap goods — now high-tech industries flourish.

2013 | Belt & Road Initiative (BRI) launched | Expands China’s trade routes via ports, railways, and pipelines.

2018 | U.S.-China trade war begins | Tariffs reveal vulnerabilities in global overdependence on China.

2020 | COVID-19 hits | Lockdowns in China freeze global supply chains. Wake-up call.

2021–2024 | Push for “dual circulation” & self-reliance | China focuses on internal demand while still dominating exports.

2024–2025 | U.S. and EU expand tariffs & decoupling efforts | Start of supply chain restructuring globally.

SUPPLY CHAIN MAP: China’s Dominance by Industry:-

Here’s how deep China is embedded in global supply chains:

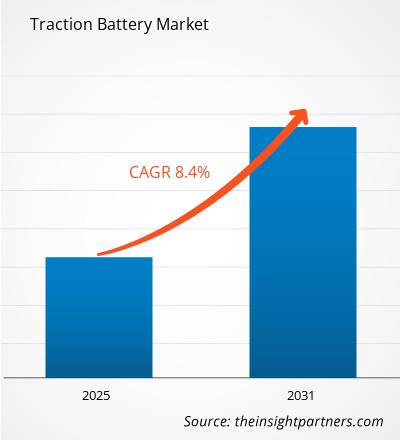

Batteries & EV Components-

Control over 70–80% of global lithium-ion battery production.

Dominates refining of critical minerals (cobalt, lithium, graphite).

Solar Panels-

Over 80% of global solar panel supply is Chinese.

Controls polysilicon processing and solar cell manufacturing.

Electronics & Consumer Tech-

iPhones, laptops, and TVs are assembled or partially produced in China.

Shenzhen = world capital of hardware production.

Steel, Cement, Construction Materials-

World’s largest producer of steel & cement.

Heavily subsidized industries outcompete foreign competitors.

Textiles & Apparel-

Still one of the top 3 exporters of fabrics, clothing, and fast fashion components.

Pharmaceuticals & Chemicals-

Key supplier of Active Pharmaceutical Ingredients (APIs).

Many generics and vitamins rely on China.

Semiconductors (Assembly & Testing)

Doesn’t lead in chip design, but dominates assembly, testing, and lower-end chip production.

GLOBAL RESPONSES:- Who’s Doing What About China’s Dominance

United States-

CHIPS Act: $52B to boost U.S. semiconductor production.

IRA (Inflation Reduction Act): Billions in clean energy & battery production.

Tariffs & export bans: Restrictions on advanced chip exports to China.

“Friendshoring”: Pushing allies to build supply chains in safer zones.

India-

“Make in India” campaign: Big incentives for electronics, chips, and auto.

Attracting Apple, Samsung, and Foxconn for manufacturing shift.

Strategic partnerships with U.S. for tech and defense supply chains.

Vietnam-

Becoming a major alternative in apparel, electronics.

Samsung, Intel, and others now produce heavily there.

Mexico-

Rising as a nearshoring hub for the U.S.

Especially strong in autos, electronics, and logistics proximity.

Japan & South Korea-

Japan is onshoring critical industries, especially semiconductors and pharma.

Korea is expanding chip production globally (Samsung, SK Hynix) while also investing in allies.

European Union-

Launching “Net-Zero Industry Act” to scale solar, wind, and batteries.

Considering tariffs on Chinese EVs.

Focused on resilience, not full decoupling.

Why It All Matters:-

China’s rise was planned, strategic, and massive — and the world got hooked on cheap, fast production.

Now, geopolitics + economic security are driving a major global shift.

Countries are diversifying, investing at home, and building alliances to de-risk the future.

By Jo Ikeji-Uju.

sappertekinc@gmail.com

https://afriprime.net/Ikeji

*Share your comments positive or negative........

SUPPLY CHAIN TIMELINE: China’s Rise in Global Trade & Supply Chain Power.

Year | Key Event | Impact

1978 | Deng Xiaoping launches "Reform and Opening Up" | Shift from planned economy to market reforms; welcomes foreign investment.

1980s | Special Economic Zones (e.g., Shenzhen) established | Factories explode in growth, becoming hubs for global export.

1990s | Explosive growth in textiles, toys, electronics | Western companies begin outsourcing en masse to cut costs.

2001 | Joined WTO (World Trade Organization) | China gets full access to global markets — boom in exports.

2000s | "Factory of the World" status | Apple, Nike, Walmart and others shift most production to China.

2010s | Moves up the value chain (tech, EVs, solar) | No longer just cheap goods — now high-tech industries flourish.

2013 | Belt & Road Initiative (BRI) launched | Expands China’s trade routes via ports, railways, and pipelines.

2018 | U.S.-China trade war begins | Tariffs reveal vulnerabilities in global overdependence on China.

2020 | COVID-19 hits | Lockdowns in China freeze global supply chains. Wake-up call.

2021–2024 | Push for “dual circulation” & self-reliance | China focuses on internal demand while still dominating exports.

2024–2025 | U.S. and EU expand tariffs & decoupling efforts | Start of supply chain restructuring globally.

SUPPLY CHAIN MAP: China’s Dominance by Industry:-

Here’s how deep China is embedded in global supply chains:

Batteries & EV Components-

Control over 70–80% of global lithium-ion battery production.

Dominates refining of critical minerals (cobalt, lithium, graphite).

Solar Panels-

Over 80% of global solar panel supply is Chinese.

Controls polysilicon processing and solar cell manufacturing.

Electronics & Consumer Tech-

iPhones, laptops, and TVs are assembled or partially produced in China.

Shenzhen = world capital of hardware production.

Steel, Cement, Construction Materials-

World’s largest producer of steel & cement.

Heavily subsidized industries outcompete foreign competitors.

Textiles & Apparel-

Still one of the top 3 exporters of fabrics, clothing, and fast fashion components.

Pharmaceuticals & Chemicals-

Key supplier of Active Pharmaceutical Ingredients (APIs).

Many generics and vitamins rely on China.

Semiconductors (Assembly & Testing)

Doesn’t lead in chip design, but dominates assembly, testing, and lower-end chip production.

GLOBAL RESPONSES:- Who’s Doing What About China’s Dominance

United States-

CHIPS Act: $52B to boost U.S. semiconductor production.

IRA (Inflation Reduction Act): Billions in clean energy & battery production.

Tariffs & export bans: Restrictions on advanced chip exports to China.

“Friendshoring”: Pushing allies to build supply chains in safer zones.

India-

“Make in India” campaign: Big incentives for electronics, chips, and auto.

Attracting Apple, Samsung, and Foxconn for manufacturing shift.

Strategic partnerships with U.S. for tech and defense supply chains.

Vietnam-

Becoming a major alternative in apparel, electronics.

Samsung, Intel, and others now produce heavily there.

Mexico-

Rising as a nearshoring hub for the U.S.

Especially strong in autos, electronics, and logistics proximity.

Japan & South Korea-

Japan is onshoring critical industries, especially semiconductors and pharma.

Korea is expanding chip production globally (Samsung, SK Hynix) while also investing in allies.

European Union-

Launching “Net-Zero Industry Act” to scale solar, wind, and batteries.

Considering tariffs on Chinese EVs.

Focused on resilience, not full decoupling.

Why It All Matters:-

China’s rise was planned, strategic, and massive — and the world got hooked on cheap, fast production.

Now, geopolitics + economic security are driving a major global shift.

Countries are diversifying, investing at home, and building alliances to de-risk the future.

By Jo Ikeji-Uju.

sappertekinc@gmail.com

https://afriprime.net/Ikeji

*Share your comments positive or negative........