Oilfield Production Chemicals Market In Depth Analysis, Growth Strategies and Comprehensive Forecast 2025 to 2035

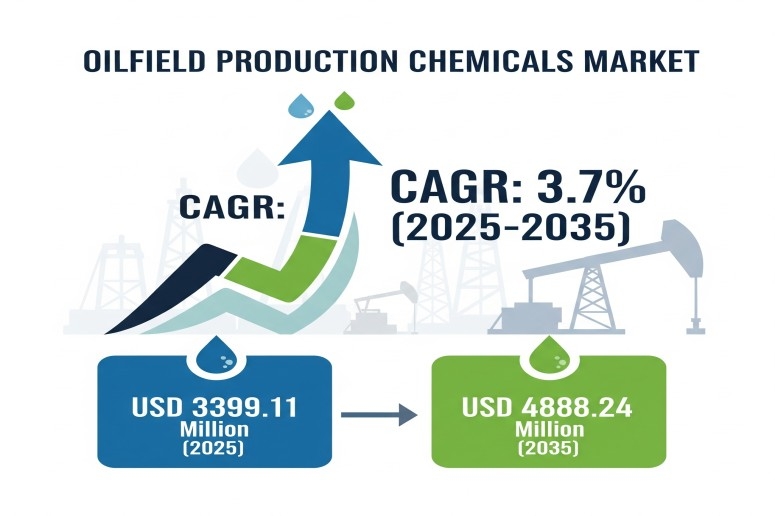

The oilfield production chemicals market is entering a pivotal decade of growth, projected to expand from USD 3,399.11 million in 2025 to USD 4,888.24 million by 2035, representing a steady CAGR of 3.7%. This growth is fueled by intensified drilling activities, increased focus on enhanced oil recovery (EOR) methods, and the pressing need to maintain consistent production volumes and quality from each field. For both established and emerging manufacturers, this market offers a strategic opportunity to innovate, expand, and introduce new technologies that enhance operational efficiency and sustainability.

Oilfield production chemicals play a critical role in upstream operations such as natural gas extraction and crude oil production. Their primary functions include enhancing operational efficiency, inhibiting corrosion and scaling, and preventing the formation of hydrates, ensuring that facilities operate smoothly and equipment depreciation is minimized. With the growing complexity of oilfield operations, these chemicals have become indispensable tools for optimizing output and extending the life of production assets.

Explore Opportunities – Get Your Sample of Our Industry Overview Now!

https://www.futuremarketinsights.com/reports/sample/rep-gb-7018

Regional Outlook: Opportunities Across Continents

- North America: The region continues to dominate the market due to ongoing shale gas production and deepwater exploration. North America leads in the deployment of EOR and well stimulation techniques that rely heavily on chemical support. Increasing environmental regulations are driving manufacturers toward greener and more efficient chemical formulations, creating opportunities for innovation in eco-friendly and high-performance solutions.

- Europe: The European market remains steady, primarily driven by operations in the North Sea. Countries such as Norway and the UK are investing in offshore assets that increasingly utilize water-soluble inhibitors, corrosion inhibitors, and demulsifiers to prolong field life. There is also a gradual shift toward eco-friendly chemical solutions to reduce environmental impact while maintaining production efficiency.

- Asia Pacific: This region is expected to exhibit the fastest growth, driven by investments in oilfield development across China, India, and Southeast Asia. State-owned companies are actively involved in both offshore and deepwater exploration, creating strong demand for production chemicals. The combination of rising energy consumption and expanding local chemical manufacturing capabilities further strengthens market prospects.

Challenges and Opportunities

While the market is poised for growth, manufacturers must navigate several challenges. Volatility in global oil prices can create investment uncertainty, impacting demand for production chemicals. Additionally, stringent environmental and safety regulations increase compliance complexity, particularly for solvent and chemical service providers.

However, significant opportunities exist. Rising global energy demand and ongoing oilfield modernization initiatives are encouraging the development of more efficient, eco-friendly chemicals. Innovative formulations, including nanotechnology-based solutions, green surfactants, and biodegradable agents, are enabling market players to offer tailored chemical solutions that address specific reservoir challenges, giving them a competitive edge.

Market Trends: 2020 to 2035

From 2020 to 2024, the oilfield production chemicals market faced disruptions due to COVID-19, fluctuating oil prices, and regulatory changes. Companies focused on cost control and operational efficiency while navigating global supply chain challenges.

Looking ahead to 2025–2035, the market is expected to grow steadily with the resurgence of upstream activities and broader adoption of EOR methods. Sustainability, digital integration, and reservoir-specific innovation will define the competitive landscape. Companies are investing in smart chemical solutions, digital fluid management, and automated dosing systems to optimize chemical usage while reducing waste and environmental impact.

Country-Specific Growth Outlook

- United States: Growth is driven by shale exploration and oil recovery activities, with a focus on scaling, corrosion, and microbial control. CAGR: 3.9%.

- United Kingdom: Offshore oil production in the North Sea supports the demand for efficient, environmentally compliant chemicals. CAGR: 3.8%.

- European Union: Technology upgrades and stricter environmental regulations drive moderate market growth. CAGR: 3.9%.

- Japan: Stable growth is supported by overseas oilfield investments and advanced corrosion inhibitors. CAGR: 4.0%.

- South Korea: Growth stems from involvement in overseas oil projects and collaboration with global operators. CAGR: 3.6%.

Segmentation Insights

- Demulsifiers dominate the market with a 27.6% share in 2025 due to their critical role in oil-water separation during upstream operations. The demand for higher-performance demulsifiers is rising, particularly as older oilfields experience higher water cuts. Companies are increasingly developing biodegradable, less-toxic formulations to comply with environmental regulations.

- Production Methods applications account for 48.9% of market share, highlighting their significance in daily oilfield operations. Chemicals such as corrosion inhibitors, scale inhibitors, and biocides ensure equipment longevity, maintain consistent production, and prevent microbial growth. Advanced extraction techniques, including horizontal drilling and hydraulic fracturing, continue to drive the need for specialized production chemicals. Real-time chemical injection monitoring and automated dosing systems are increasingly adopted to enhance operational efficiency and reduce waste.

Competitive Landscape

The oilfield production chemicals market is characterized by a mix of global leaders and emerging innovators. Key players include:

- Schlumberger Limited (15–18%): Offers environmentally optimized chemicals for EOR and scale inhibition, with digital monitoring tools enhancing reservoir-specific performance.

- Halliburton Company (13–16%): Provides production chemicals for flow assurance, corrosion control, and microbial remediation, integrated with comprehensive service offerings.

- Baker Hughes Company (11–14%): Specializes in AI-powered chemical management and remote monitoring systems, improving well productivity while minimizing downtime.

- BASF SE (9–12%): Focuses on specialty chemicals for emulsion breaking, paraffin control, and H₂S scavenging, supporting harsh environmental operations.

- Ecolab Inc. (Nalco Champion) (7–10%): Supplies water treatment, demulsifiers, and integrity chemicals for onshore and offshore operations.

- Other Players (35–45%): Includes Clariant AG, Croda International Plc, Kemira Oyj, Stepan Company, and Innospec Inc., offering niche solutions in corrosion prevention, eco-friendly surfactants, paraffin dispersal, and production optimization.

These companies are actively expanding their portfolios to incorporate sustainable, multifunctional, and reservoir-specific chemicals. Emphasis on digital integration and environmentally friendly formulations positions both established and new market entrants to capture emerging opportunities.

Get the Full Market Insights – Request the PDF Now!

https://www.futuremarketinsights.com/reports/brochure/rep-gb-7018

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

- Questions and Answers

- Opinion

- Motivational and Inspiring Story

- Technology

- Live and Let live

- Focus

- Geopolitics

- Military-Arms/Equipment

- Sicurezza

- Economy

- Beasts of Nations

- Machine Tools-The “Mother Industry”

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Health and Wellness

- News

- Culture